The bottom line, the short-term trend is up. I hold partial long position over the weekend.

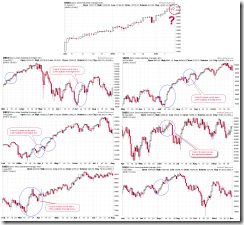

As mentioned in the last night report, either the 2.5%+ pullback had started or it’s never going to happen until Galaxy far far away. Well, look at the chart below, comparing now with the past 9 cases, in order for the pullback to continue, immediately after the very 1st down day after 7+ consecutive up days, we should get a follow-through (another red day or at most small green), shouldn’t we? Do you think today’s up is the follow-through for yesterday? So looks like chances are good that the market will continue up from here, won’t it? Seasonality favors bears the next and next next week, so I’ll give bears some more days, but just don’t hope too much.

Enjoy your weekend!

Demo account for short-term model, $200 max loss allowed per trade. Mechanical trading signal, for fun only.

| TICKER | Entry Date | Entry Price | Share | Stop Loss | Exit Date | Exit Price | Profit | Comment |

| SSO | 02/11/2011 | $52.87 | 100 | $51.78 | ||||

| SSO | 02/11/2011 | $52.87 | 100 | $51.78 | 02/11/2011 | $53.36 | 49.00 | Partial profit to lock SDS losses. |

| SDS | 02/10/2011 | $21.68 | 500 | $21.27 | 02/11/2011 | $21.29 | -195.00 | |

| SSO | 02/09/2011 | $52.91 | 200 | $51.84 | 02/10/2011 | $53.03 | 24.00 | |

| SSO | 02/07/2011 | $52.67 | 400 | $52.10 | 02/07/2011 | $52.84 | 68.00 | Rare case for low risk entry. |

| SSO | 02/04/2011 | $51.78 | 200 | $50.81 | 02/04/2011 | $51.98 | 40.00 | |

| SSO | 02/02/2011 | $51.72 | 200 | $50.69 | 02/03/2011 | $51.86 | 28.00 | |

| SSO | 02/01/2011 | $51.03 | 50 | $51.23 | 02/02/2011 | $51.62 | 29.50 | |

| SSO | 02/01/2011 | $51.03 | 50 | $49.23 | 02/01/2011 | $51.46 | 21.50 | Partial profit to lock SDS losses. |

| SDS | 01/31/2011 | $22.77 | 300 | $22.09 | 02/01/2011 | $22.09 | -204.00 | |

| JAN | 415.00 | |||||||

| SUM | 276.00 |