|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

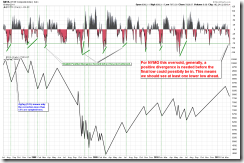

SHORT-TERM: COULD SEE REBOUND AS EARLY AS TOMORROW BUT THERE’LL BE A LOWER LOW AHEAD

Three things:

- C0uld see a rebound as early as tomorrow.

- Sell off might not be over yet, so today’s low is not the low.

- Trading wise, sell bounce is still the name of the game. See short-term model in the table above for more details.

Why I expect a rebound?

As mentioned in today’s After Bell Quick Summary, bulls have 76% chances tomorrow.

6.3.2a Major Distribution Day Watch, a Major Distribution Day (NYSE Down Volume : NYSE Up Volume >= 9) means 37/56 (66%) chances for bulls tomorrow.

0.2.3 NYSE McClellan Oscillator, NYMO oversold is a very reliable signal, one of my favourite.

Why today’s low is not the low?

Very oversold NYMO means a VISIBLE positive divergence is a must before a meaningful bottom. What does VISIBLE mean? The index must rebound for a few days first then fall back below the previous low while NYMO hold above its previous low to form a positive divergence. Let’s say tomorrow, the index keeps selling off and we have a lower low then rebound huge, NYMO in this case may have a higher low, well, too bad, that is not a visible positive divergence. Must be a rebound (say, starting from tomorrow) for a few days then falls back below today or tomorrow’s low, whichever is lower, then we shall have the visible positive divergence.

Two Major Distribution Day within 2 days, so could see a short-term rebound (see dashed blue lines), could not (see dashed red lines), whichever the cases, the point is the sell off mostly continues thereafter.

INTERMEDIATE-TERM: COULD NOT BE VERY BRIGHT BUT STATISTICALLY BULLISH IN 3 TO 6 MONTHS

See 03/11 Market Recap for more details.

SEASONALITY: BULLISH MONDAY

According to Stock Trader’s Almanac:

- Monday before March Triple Witching, Dow up 17 of last 23.

- March Triple Witching Day mixed last 10 years, Dow down 3 of last 4.

For March seasonality chart please refer to 03/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ&Weekly | UP | |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | |

| EEM & Weekly | DOWN | |

| XIU & Weekly | UP | 1.5.1 TSE McClellan Oscillator: Oversold. |

| TLT & Weekly | UP | |

| FXE & Weekly | UP | (weekly) Testing Fib confluences area. |

| GLD & Weekly | UP | |

| GDX & Weekly | UP | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | UP | |

| IYR & Weekly | UP | |

| XLB & Weekly | DOWN | |

| DBA & Weekly | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.