|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

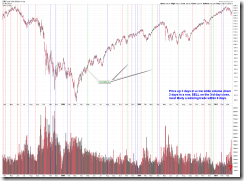

SHORT-TERM: COULD BE HEAD AND SHOULDERS BOTTOM BREAKOUT, TARGET $134.44

Two cents:

- Short-term trend is up, not confirmed but my guess is there could be more on the upside.

- Short-term, I’ll buy on strength only, not buy dip. Intermediate-term still is in downtrend, maintain the forecast for calling a lower low ahead.

For 2 reasons, I guess there could be more on the upside.

- Head and Shoulders Bottom breakout. I don’t essentially believe the target but won’t deny this could be a bullish pattern either.

- INDU Leads Market. Since INDU broke above MA(50) today so expect the SPX to follow soon.

In addition, there’re two things I’d like to remind you today:

The long setups mentioned on 03/16, some met the close condition.

There is a potential short setup which surprisingly works well. Personally, I don’t like this kind of setup though.

INTERMEDIATE-TERM: BULLISH IN 3 TO 6 MONTHS

Combine the study mentioned in 02/23 Market Recap and 03/11 Market Recap, I still believe that 02/18 high will be revisited.

SEASONALITY: BEARISH THE NEXT WEEK

According to Stock Trader’s Almanac:

- Week after Triple Witching, Dow down 15 of last 23, but rallied 4.9% in 2000, 3.1% in 2007 and 6.8% in 2009.

- March historically weak later in the month.

For March seasonality chart please refer to 03/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ&Weekly | DOWN | |

| IWM & Weekly | UP | |

| SSEC & Weekly | UP | |

| EEM & Weekly | DOWN | |

| XIU & Weekly | UP | |

| TLT & Weekly | UP | |

| FXE & Weekly | UP | |

| GLD & Weekly | UP | |

| GDX & Weekly | 03/15 S | |

| USO & Weekly | UP | |

| XLE & Weekly | UP | |

| XLF & Weekly | DOWN | |

| IYR & Weekly | UP | |

| XLB & Weekly | DOWN | |

| DBA & Weekly | DOWN |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- * = New update; Blue Text = Link to a chart in my public chart list.

- UP = Intermediate-term uptrend. Set when weekly buy signal is triggered.

- DOWN = Intermediate-term downtrend. Set when weekly sell signal is triggered.