|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: MONDAY AND FRIDAY ARE BULLISH

See 04/30 Market Recap for more details.

CYCLE ANALYSIS: COULD BE A CYCLE TOP AROUND 05/03 TO 05/10

See 04/30 Market Recap for more details.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD OR THE MARKET COULD BE TOPPED

See 04/30 Market Recap for more details.

SHORT-TERM: COULD SEE REBOUND BUT COULD BE MORE SELLINGS AFTER THE REBOUND

Today is a Major Distribution Day (NYSE Down Volume : NYSE Up Volume >= 9). There’re 3 rules about the Major Distribution Day:

- 6.3.2a Major Distribution Day Watch, the day after a Major Distribution Day is more likely a green day.

- 6.3.2b Major Distribution Day Watch, 2 Major Distribution Day within 5 days confirms an intermediate-term down trend, although a short-term rebound is also very likely.

- 6.3.2c Major Distribution Day Watch, the market bottomed when NYSE Down Volume : NYSE Up Volume >= 35.

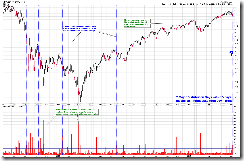

Among those 3 rule, the rule number two is of the most importance to us for now, because today is the 2nd Major Distribution Day in the past 5 days. The chart below should be clear enough to prove the rule – short-term rebound maybe, but more selling ahead after the rebound.

If indeed as the 2nd Major Distribution Day rule argues, more selling ahead, then the text book target, according to the Diamond Top pattern, is around $114.38, which means that the January highs could be tested. Take a look at 1.0.0 S&P 500 SPDRs (SPY 60 min), if interested, the pattern could also be seen as a Complex Head and Shoulders Top, the target is almost identical to that of the Diamond Top.

For tomorrow, not only the Major Distribution Day rule number 1 (see After Bell Quick Summary) says a green day, but also there’re 2 additional charts argue so:

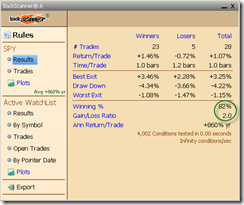

0.2.0 Volatility Index (Daily), VIX rose more than 18%, buy at today’s close sell at tomorrow’s close, bull has 82% chances.

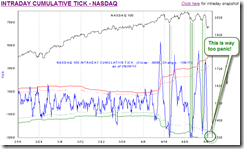

Intraday Cumulative TICK from sentimentrader, way too panic, so it also argues for a rebound tomorrow.