|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

SEASONALITY: A LITTLE BIT BEARISH BIASED THE NEXT WEEK

See 06/04 Market Recap for more details.

INTERMEDIATE-TERM: PULLBACK TARGET AROUND 1008 TO 1019, TIME TARGET AROUND 06/11 TO 06/14

See 06/04 Market Recap for more details.

SHORT-TERM: STATISTICS DO NOT AGREE THAT THE MARKET HAS BOTTOMED

Still the same old question: Has the market bottomed?

Well, it depends on what you believe. If you believe the government as well as Helicopter Ben are capable of anything (you see the true identity of the Helicopter Ben below?) then maybe, probably, possibly, we’ll see a bull market we’ve never experienced before and have an once in a life time opportunity to retire earlier.

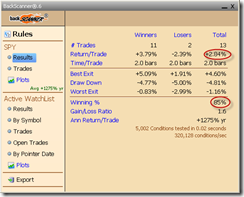

I don’t understand politics, so right now all I can say are since year 2000, whenever SPY rose more than 1% while QQQQ closed in red like today, short SPY at today’s close and cover 2 days later at close, there’re 85% chances that you could gain 2.84% in average.

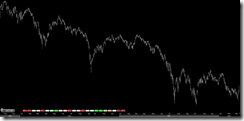

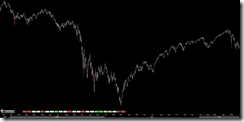

The chart below highlighted all the past cases when SPY rose more than 1% while QQQQ closed in red. See for yourself what happened thereafter as I think it’s better than merely read the statistics. Well, almost all happened during the bear market, by the way.

The other statistics is from sentimentrader: the Nasdaq Composite Index had back-to-back Arms Index (TRINQ) readings above 3 (that’s 06/07), bought the Nasdaq Comp the next next day (that’s 06/09) then held it going forward, we would have received the following returns:

|

Date |

1 Day Later |

1 Week Later |

2 Weeks Later |

1 Month Later |

3 Months Later |

| 03/13/01 | -2.1% | -7.8% | -2.1% | -5.8% | 7.7% |

| 07/09/01 | -3.2% | 0.1% | -1.9% | 0.1% | -16.1% |

| 02/20/02 | -3.3% | -1.3% | 6.5% | 5.3% | -6.3% |

| 04/24/02 | 0.0% | -2.1% | -1.0% | -0.9% | -24.7% |

| 06/04/02 | 1.1% | -5.1% | -2.2% | -12.5% | -19.9% |

| 06/21/02 | 1.3% | 1.5% | -2.5% | -14.7% | -15.3% |

| 06/24/02 | -2.5% | -3.9% | -5.4% | -11.7% | -18.9% |

| 09/04/02 | -3.2% | 1.8% | -3.1% | -9.8% | 12.1% |

| 10/16/08 | -0.4% | -6.6% | -1.1% | -11.7% | -11.0% |

| Average | -1.4% | -2.6% | -1.4% | -6.9% | -10.2% |