|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: THE LATER HALF OF THE NEXT WEEK IS GENERALL BULLISH

According to the Stock Trader’s Almanac:

- Monday (04/12) before OE, Dow down 4 of last 5.

- 04/15 income tax deadline, Dow down only 5 times since 1981.

- April expiration day, Dow up 11 of last 13.

CYCLE ANALYSIS: CYCLE TOP COULD BE AROUND 04/11 TO 04/15

See 04/08 Market Recap for more details.

INTERMEDIATE-TERM: EXPECT ROLLER COASTER AHEAD

Nothing new, according to the II Survey, too many people expected a correction, so the stock market should rise to a new high first before actually pulling back. Basically, my guess is that we’ll repeat the year 2004 roller coaster pattern. See 03/19 Market Recap for more details.

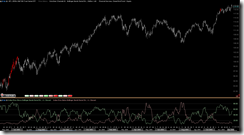

SHORT-TERM: A STRONG EARNINGS OFF-SEASON USUALLY MEANS A WEAKER EARNINGS SEASON

More extremes became more extreme on Friday, see table above marked by “*” signs. However, although it feels that the market is very very bullish but in terms of rising points, what the market done in the past 44 trading days is just equal to the 27 trading days rally starting July the last year, so the up momentum is actually not as strong as it FEELs. Besides, even the much stronger upward push like March the last year took a breathe after the same 44 trading days rally. So, maybe, possibly, probably the rally since 02/05 is very close to an end.

As mentioned in the 04/08 Market Recap, the next week could be a cycle top. The next week also is the start of a new earnings season, there’re 2 statistics, happened to say that the coming earnings season may not be very pleasant.

The first statistics is from sentimentrader.

Here is how the S&P 500 performed during the last 10 earnings seasons (lasting about 26 days) when it was trading at a new 52-week high entering the season:

Date

Return

Max

Loss

Max

Gain

07/08/97 0.9% -1.8% 4.9% 10/06/97 -5.0% -12.1% 1.1% 01/08/99 -2.6% -5.5% 0.7% 04/07/99 2.2% -3.2% 3.4% 07/07/99 -8.2% -9.2% 1.8% 01/08/04 1.3% -1.5% 2.4% 01/09/06 -0.6% -2.8% 0.4% 10/10/06 2.9% -0.7% 3.0% 10/09/07 -5.4% -8.1% 0.7% 01/11/10 -3.3% -8.9% 0.3% Average -1.8% -5.4% 1.9%

Overall, not so hot. It didn't manage to sustain a +3% gain during any of them, but it did close more than -3% lower four times. Six times, the maximum loss was larger than the maximum gain. Also six times it never managed to gain any more than +2% at any point during the season, but seven times it lost more than -2% at some point.

The second statistics is from Bespoke.

Historically, the S&P 500 has averaged a decline of 0.28% during earnings season, while it has averaged a gain of 0.76% during the earnings off-season. When the market has been up in the previous off-season, the average performance during earnings season moves even lower to –0.36%. It’s a typical buy the rumor/sell the news scenario.

So to summarize the above, the up momentum is not as strong as that of before, even the much stronger upward push like March the last year had to take a breathe after a 44 trading days rally, plus the cycle and the statistics about the coming earning seasons, all are arguing that the SPX could take a breathe as early as the next week. And lastly, don’t forget all the bearish extremes accumulated in the table above, definitely they will work eventually.

Below are some new extremes, take a look if interested, otherwise the weekend report ends here.

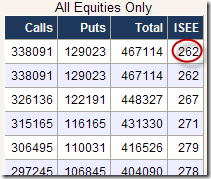

ISEE Equities Only Index closed above 260 again on Friday. The charts below listed all the past extremes.

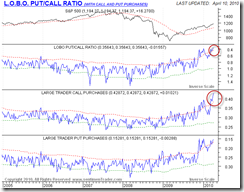

I mentioned in the 04/05 Market Recap that people bought lots of CALLs. Here’s the latest Large Trader Call Purchases chart, nothing changed, still buying CALLs, lots of.

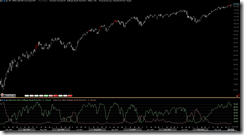

Options Speculation Index is the bullish bias (call buying and put selling) transactions to bearish bias (put buying and call selling) transactions ratio, new high again.

Rydex traders bought more stocks this week.

The idea below is from Bespoke, percent of SPX stocks 1+ standard deviation above MA(50). See bars highlighted in red (when readings > 75).

The indicator above however, failed to work only once in 2003 when the SPX just rallied from the bottom which should be equivalent to March the last year therefore I don’t think that now will repeat what happened in 2003.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in BUY mode, only LONG candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.

Looks like it’s too late to long stocks now as the market is way too overbought. Waiting for a better chance.