|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: BULLISH, BUT WILL MAINTAIN INTERMEDIATE-TERM BEARISH VIEW

All I wanted to say are already in today’s After Bell Quick Summary: Since the market has chosen to decisively breakout of the consolidation area on the upside so the short-term is bullish while bears have to wait for the next consolidation area before any possible counterstrikes.

However for the intermediate-term, I’ll maintain the bearish view. The main reasons are:

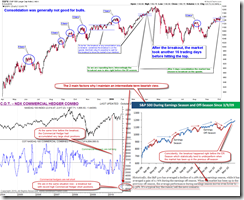

- As mentioned in 10/01 Market Recap, the Commercial Hedgers have piled up historical high Nasdaq 100 short positions.

- Statistically, the Earning Season starting within this week may very likely underperform, because the market was up a lot in off-season.

The chart below should clearly illustrate the similarity between now and the 04/01/2010 breakout, therefore the worst case for bears, maybe another 16 trading days upswing ahead.

As for the possible price and time target for the “another 16 trading days upswing”, I need see a follow-through tomorrow before further blah blah, in case we see yet another reversal of reversal of reversal. Overall, as long as the market doesn’t drop huge tomorrow, I’d consider today’s breakout as valid and in this case the pivot date around 10/05 I mentioned in 10/01 Market Recap would become invalid, while the pivot date around 10/11 would have to “wait and see”.

INTERMEDIATE-TERM: SEEMS 11%+ RISE GUARANTEED BEFORE YEAR END, I’M SKEPTICAL HOWEVER

See 10/01 Market Recap for details.

SEASONALITY: OCTOBER IS BULLISH

See 10/01 Market Recap for October Seasonality chart.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | COMMENT | |

| QQQQ | *UP | 4.1.1 Nasdaq 100 Index (Weekly): NDX to SPX ratio too high. |

| IWM | *UP | |

| CHINA | ||

| EMERGING | UP | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| CANADA | *UP | *TOADV MA(10) too high and has negative divergence. |

| BOND | *DOWN | |

| EURO | UP | |

| GOLD | UP | |

| GDX | *UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. |

| OIL | UP | |

| ENERGY | *UP | |

| FINANCIALS | *UP | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | UP | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging. |

| MATERIALS | *UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no specific buy/sell signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update.

- Blue Text = Link to a chart in my public chart list.

- LA = Lateral Trend.