|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: MORE REBOUND THEN A 2ND LEG DOWN

The huge rebound today was expected, especially if you paid enough attention to the chart I gave yesterday about 2 Major Distribution Day within 5 Trading Days (6.3.2b Major Distribution Day Watch), so I’ll maintain what I said yesterday that the intermediate-term is in danger of turning into downtrend.

For short-term, I’ll say: Be careful! Because on one hand people were buying crazy while on the other hand the OEX Put Call Ratio skyrocketed high again. So basically, I’ll maintain what I said in today’s After Bell Quick Summary: An immediate higher high (higher than today’s high) is almost guaranteed on Friday, probably we’ll see more rebound thereafter but eventually there will be a 2nd leg down.

Let’s begin with how crazy people were buying today. If you’ve been reading my blog since the beginning of this year, you may remember the WOW. Remember what happened thereafter (See HERE for the past 11 WOWs)? I’m not sure if I can say WOW today but the Nasdaq Intraday Cumulative TICK is, well, a little bit too extreme. The reading of 7431 is extreme even in that amazing WOW age, so be careful here.

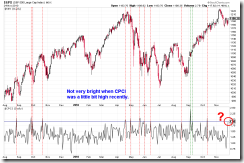

On the other hand, still remember what I mentioned in 11/22 Market Recap about skyrocketed high OEX Put Call Ratio? Well, more extremes today. This is very likely an intermediate-term top sign. Please refer to 11/22 Market Recap for the past history.

Since the OEX Put Call Ratio skyrocketed high then inevitably the CPCI is very high too. The chart below highlighted all recent cases whenever CPCI >=1.90. At least it’s a short-term top, wasn’t it? The failed cases were very very rare, weren’t it? Here, let me emphasis again, I draw conclusion only from charts, so don’t tell me because of blah blah blah, so this time is different or it’s way too illogical. If you always tend to think that this time is different, then better forget about TA, period.

The last evidence, not the least of course, about why we’ll see more rebound then a 2nd leg down. See chart below, marked by dashed blue lines are all past cases a Major Accumulation Day happened right after a Major Distribution Day (This is exactly what happened today and yesterday). The samples are too few but combining all the evidences I’ve given recently and how crazy the market is now, so odds are good that we may repeat exactly the past pattern – rebound then a 2nd leg down. So again, be careful!

INTERMEDIATE-TERM: 2 MAJOR DISTRIBUTION DAYS WITIN 5 DAYS MEANS MORE PULLBACKS AHEAD

The intermediate-term is in danger of entering a downtrend. See 11/23 Market Recap for more details.

SEASONALITY: 59% CHANCES, BUY TUESDAY SELL FRIDAY COULD BE A WINNING TRAD IN THANKSGIVING WEEK SINCE 1988

See 11/19 Market Recap for more details.

For November seasonality chart please refer to 11/11 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 11/16 S | |

| NDX Weekly | UP | NASI STO(5,3,3) sell signal. |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | Big red bar means more pullbacks ahead, so be careful. | |

| CHINA Weekly | UP | |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 11/16 S | |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 11/16 S | |

| GDX Weekly | UP | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 06/15 L | |

| XLE Weekly | UP | %B is too high with negative divergence. |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 11/16 S | |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.