|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: THE REBOUND TODAY IS MORE LIKELY TO FAIL

The rebound today stopped right at Fib 50%, so it’s very hard to say whether the rebound was over or there’s more, need see tomorrow. Basically, I believe the rebound eventually would fail and at least the today’s low will be tested. The reasoning is, besides the general pattern, you Earth people (remember, I’m from Mars?) always like to try twice before trying the opposite side, the ChiOsc on SPY 60 min chart is way too high which means at least an intraday pullback.

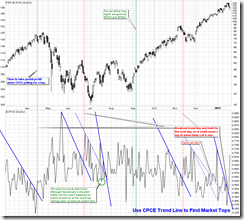

Nothing else to say, whether the 01/18 highs is the high, bears at least need show us a 1-2-3 Trend Change pattern. So far, I don’t see one, so again, we’ll have to wait. From all the bearish signals piled up in the table above, chances that 01/18 highs is the high are fairly high, especially today we have yet another reliable top signal confirmed: 0.0.2 Combined Intermediate-term Trading Signals. The 3 point validated trend line was broken yesterday, but given the lesson I learnt last time, I didn’t blah blah yesterday. But today, no doubt, it’s a clear breakout, so I believe the top signal is valid and confirmed. Well, let’s see if it works or not this time.

INTERMEDIATE-TERM: COULD BE WAVE 5 UP TO SPX 1300+, PIVOT TOP COULD BE AROUND 01/05 TO 01/12

The price and time target I’ve been blah blah for the intermediate-term has finally been met, although the time target seems a little too early but let’s give it another week to see whether the forecast is good or bad. See 01/14 Market Recap for more details.

SEASONALITY: BULLISH TUESDAY, BEARISH FRIDAY, HORRIBLE WHOLE WEEK

See 01/14 Market Recap for more details. Also see 12/31 Market Recap for the January seasonality chart.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | *01/20 S | |

| NDX Weekly | UP | Too far away from MA(200) and BPNDX is way too overbought. |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | *DOWN | |

| EEM | *Testing major trend line. Could be an Ascending Triangle in the forming. | |

| EEM Weekly | UP | |

| XIU.TO | 01/06 S | |

| XIU.TO Weekly | UP | Weekly Bearish Engulfing, be careful. |

| TLT | 0.2.1 10Y T-Bill Yield: Symmetrical Triangle? So bond should keep falling? | |

| TLT Weekly | UP | |

| FXE | ||

| FXE Weekly | DOWN | |

| GLD | 1-2-3 trend change, wait for further confirm, GLD may fall into a downtrend. | |

| GLD Weekly | UP | |

| GDX | 12/17 S | 1-2-3 trend change confirmed, so GDX could be topped. Be careful about gold itself. |

| GDX Weekly | DOWN | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 06/15 L | *Testing major trend line and MA(20). |

| XLE Weekly | UP | Too far away from MA(200). |

| XLF | 10/15 L | |

| XLF Weekly | UP | Testing resistance which also is multiple Fib confluences area. |

| IYR | *Could be an Ascending Triangle in the forming. | |

| IYR Weekly | UP | |

| XLB | 01/19 S | *Testing major trend line and MA(50). |

| XLB Weekly | UP | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.