|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

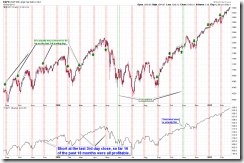

SHORT-TERM: COULD SEE RED DAY OR TWO BUT HARDLY THIS IS A TOP

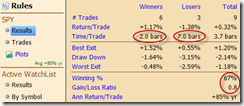

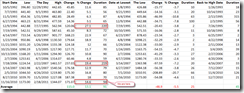

We could see red day the next Tuesday and/or next Wednesday, but this could hardly be a top. The reason is listed below, not solid, but reasonable, after all, SPY closes 14 consecutive days above MA(5) is over extended. Of course it also means the up momentum is very strong, therefore chances are very low for a sudden turnaround. Short at Friday’s close and cover at the very first day closes below MA(5) since 1991, the winning rate is 67%. The chart below also lists one by one all the past 9 cases which clearly I see:

- 6 out of 9, the next Tuesday closes in red (could be small red).

- 6 out of 9, the next Wednesday closes below MA(5) (A little bigger pullback).

- If, however, a green Tuesday again, then the market could go up to 7 more trading days on average.

- Only 1 out of 9 was the top, but I think the context is irrelevant to that of now because that was a bear market oversold rebound.

INTERMEDIATE-TERM: COULD BE NO 2.5%+ PULLBACK FOR 85 MORE TRADING DAYS, BEARS MAY WAIT ANOTHER WEEK, BUT DON’T HOPE TOO MUCH

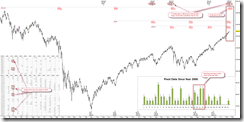

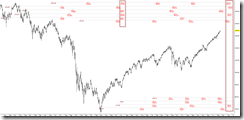

In 02/04 Market Recap, I mentioned the 40 to 61 trading day threshold for not having 2.5%+ pullback, now we’re already on the 65th trading day but still no sign of any bigger pullback, so chances are better and better, we could have no 2.5%+ pullback for as long as another 85 trading days. The statistics below highlighted the past 2 cases that the market was up 150 trading days without 2.5%+ pullback. Each rose 19% and 27% while now we have only rose 14%, so there’s still much on the upside.

For bears, on the other hand, 65 trading days without 2.5%+ pullback is not much above the 61 trading day threshold, so there’s still some wiggle room, especially:

- Seasonality is bearish the next week (see seasonality session below).

- Lots of time related turn date confluences in the next week.

- Full Moon on 02/18.

- Solar Term date on 02/19.

- Short-term session above shows that the next Tuesday and Wednesday could be in red.

So, still there’s a hope that we could see 2.5%+ pullback the next week.

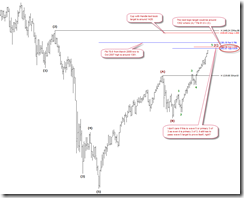

Personally, based on the same reason given by short-term session above (strong up momentum as shown by 14 consecutive days closes above MA5 cannot simply disappear all of sudden), although I cannot exclude the possibility that we’ll see a 2.5%+ pullback the next week, but I do believe that chances are pretty low that we’re now around an intermediate-term top. The chart below illustrated the possible intermediate-term price and time target. I don’t have solid proof to convince you about these targets, so they’re just some rough ideas. A little explanation about the time target: Because so many cycle turn dates are due in April, so April could be the next important pivot point. This is very similar to the multiple cycle turn date due in July 2009 when it actually marked the beginning of the current bull market (institutions were not convinced during the March to June rally).

The chart below is the risks I see for the intermediate-term. Between them, I believe the weekly EMA(13) and EMA(34) spread is the most reliable one as because of the gravity, the most reliable indicator is the spread between 2 moving averages. Now we tied the 3rd record, another SPX 50 points up, we may pretty much at the all time record high, which is roughly at the Cup with Handle text book target at 1428 shown on the intermediate-term price target chart above.

SEASONALITY: BEARISH THE NEXT WEEK

According to Stock Trader’s Almanac, week after February expiration week, Dow down 9 of last 12.

Also according to 6.5.2b Month Day Seasonality Watch, the last 2 trading days of every month since August 2009 has been constantly bearish.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | |

| NDX Weekly | UP | |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | UP | No higher low yet but the rebound is so strong so could be in uptrend now. |

| EEM | ||

| EEM Weekly | DOWN | |

| XIU.TO | 02/04 L | TOADV MA(10) is a little too high, all led to a pullback of some kind recently. |

| XIU.TO Weekly | UP | *Too far above MA(200), %B too high. |

| TLT | ||

| TLT Weekly | DOWN | |

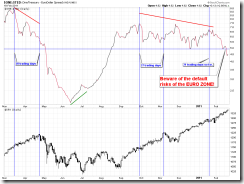

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 02/03 L | |

| GDX Weekly | UP | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 02/09 S | |

| XLE Weekly | UP | Too far above MA(200). |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 02/09 S | |

| XLB Weekly | UP | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.