|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

SHORT-TERM: NOT SURE ANOTHER DOWN LEG HAS STARTED, EVEN THE MARKET COULD BE BOTTOMED

I’m not sure another down leg has started today. Even the market could have bottomed. The reasons are price overlapping (both price bars and swings), which doesn’t look like an impulse wave down, and the volume surge, which more often than not means a bottom.

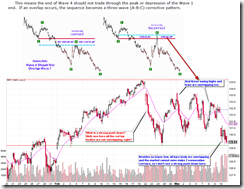

The chart below compares the Jan 2010 pullback with the Nov 2010 pullback and explains what a strong push down looks like and what the price overlapping is. And it should have explained why the January pullback could go further than that of November pullback. Now comparing to our current price pattern as shown above, it should be obvious whether we are now like January or November. I don’t mean we’re going to repeat November, I’m just saying that so far we don’t have an impulse wave down yet, so not sure whether another down leg has started.

The chart below illustrates what happened recently after a volume surge, especially if the surge was after a few down days. And this is why I cannot exclude the possibility that a capitulation or sell exhaustion has happened today therefore a rebound could start as early as tomorrow.

INTERMEDIATE-TERM: COULD NOT BE VERY BRIGHT

See 03/04 Market Recap for more details.

SEASONALITY: NO UPDATE

For March seasonality chart please refer to 03/01 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | |

| NDX Weekly | UP | |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | UP | |

| EEM | ||

| EEM Weekly | UP? | |

| XIU.TO | 03/09 S | *1.5.1 TSE McClellan Oscillator: Oversold. |

| XIU.TO Weekly | UP | |

| TLT | Could be a channel breakout, trend may about to change. | |

| TLT Weekly | ? | |

| FXE | ||

| FXE Weekly | UP | Testing Fib confluences area. |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 02/03 L | |

| GDX Weekly | UP | |

| USO | ChiOsc is way too high. | |

| WTIC Weekly | UP | Too far above BB top. |

| XLE | *03/10 S | |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | ? | Small lower low wait for follow through to confirm the trend change. |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 02/09 S | |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.