SHORT-TERM MODEL NOT SURE IF THE TREND IS DOWN, HOLDING BOTH LONG AND SHORT OVERNIGHT

The bottom line, the feeling is no good, but if my feeling could forecast the market well, I should be sunbathing at a famous beach now, the reality is I’m still blogging here so pretty much proves that my feeling has no credit.

Let’s see how “Bearish Thursday” plays out tomorrow. Since the Aug lows, the Thursday had 60% chances to close in red, not a high odds, but still better than Monday, Tuesday and Wednesday that all had above 70% chances to close in green.

THX!!!

ASTRO Update Moon Cycle…

http://astrofibo.blogspot.com/2011/10/moon-cycle-september-october-2011.html

AAPL Update Fibo…

http://astrofibo.blogspot.com/2011/10/aapl-fibo_18.html

SP500 Update Time Ratio…

http://astrofibo.blogspot.com/2011/10/sp500-fibo_18.html

Thanks Cobra!

Thanks Cobra!

Good feelings.

Look at the pattern after 08/08/2011 (08/08/2011 to a week later). Initially one red one while repeated then went up.

Reversing the pattern to today, repeating one white one red, then market should go down, per mathematical symmetry.

my 2c

I was just preparing to post that same thing! I’m guessing you work at Intel and went to OreSt?

been watching that pattern form as well. hope it actually follows through with something like a big red day tomorrow, smaller red day on friday, EFSF euro positive news over the weekend to change the trend on monday. most of this is speculative, but it’s the general pattern that i’m going to work with.

I like buying SPY at the 50% retrace (1150ish), but I’d much prefer that occurs AFTER Sunday night EU meeting news regarding EFSF. It’ll be hard to hold any sizeable position into the weekend.

As you can see from the 5th candle in the first pattern, there was some overlap with the 4th candle, could explain what we’re seeing with futures marginally up right now.

Turnaround Tuesday has been in effect lately, so maybe we’ll see 1150s on Monday or Tuesday.

The attach cycle chart lines up with the 25-26th as a turn date and 1150 would be 50% retracement of the entire move. But it may drag the process out until November 2nd which is the next cycle date.

Spuderik:

are you bearish biased? if so why would you buy (long) spy at 50% retracement?

I am near term (days) bearish, medium term (weeks) bullish, long term (months) bearish. I would buy at the 50% retracement because I don’t think the counter-trend bullish move in the medium term has played out entirely as of yet. Sentiment is still far too bearish. Put-call ratios are way too high still. I also think the 200 day MA is a logical end point for the bear market rally. Timing-wise it would make sense for the bear market rally to last into November, and possibly early December (based upon length of previous bear market rallies). I lean more towards price levels than timeframes though.

In particular, I am short as of 1222 (had to chase because my 1235 level order didn’t fill today). I will close it at 1170 gap fill (should we see it), or a break of 1235 (stop out level). Then I sit and wait for 1150, if it happens I’ll go long and hold until the 200 day MA is reached (~1270). Then I’ll take what I consider the BIG trade to the downside. A put option position out until June 2012 for a breakdown to 1000 or below in the S&P. Granted, there are lots of hiccups and chaos between here and there, so I’ll have to adjust my trading plan accordingly based upon developments.

Hmm, interesting, thanks.

Please don’t let my boss sniff I am here at daytime. Smart insight.

beaver at Beaverton, Oregon

Spuderik: are you leaning toward bearish direction for next bar(s)?

yes. Thanks you very much Cobra.

Thanks a lot!

NYSE summation and BPNYA send a similar message: short term there could be weakness, medium term more strength:

I redrew some lines/ellipse on the BPNYA chart because they were sliding around. New version does not change anything, weekly BPNYA at resistance, but looks good medium term.

thx,ding

thank you

test

谢谢蛇老大

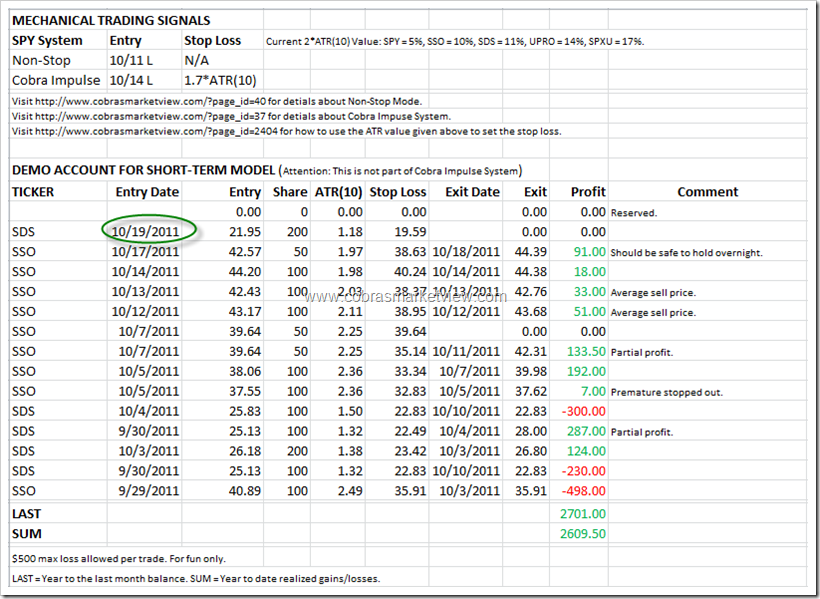

How does you system decide to take partial profit or to exit? All based on your signal ?

Watching RUT:SPX ratio here and seeing some analogies with 2010 bottom.