SHORT-TERM: IN WAIT AND SEE MODE

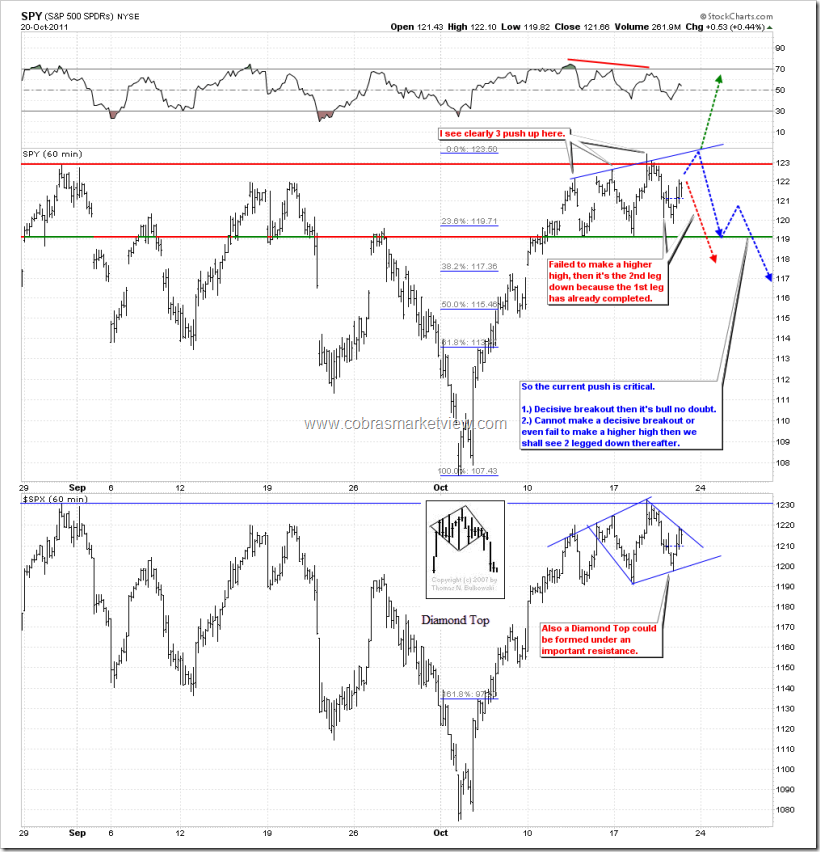

A top of some kind could be in or very close. That said, all the evidences I have are option related, could be due to OE tomorrow therefore may not be solid enough. So, in addition I have a chart below explaining what I’d closely watch tomorrow. Bulls need a decisive breakout, any failure would only confirm the bearish patterns (or more precisely my speculation) mentioned in the chart: 3 Push Up or Diamond Top.

Now my witnesses for top:

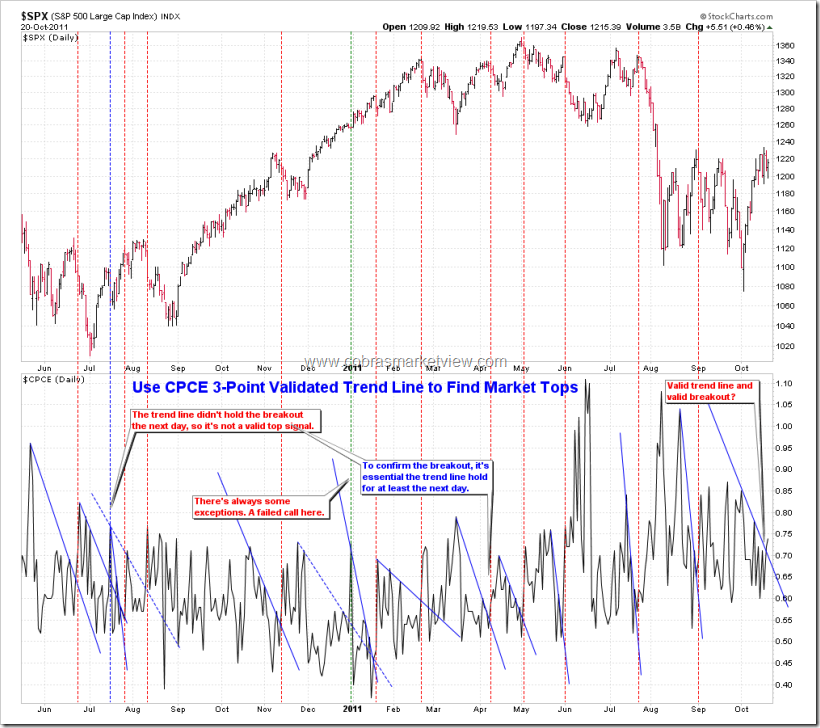

- CPCE broke a 3 point validated trend line, which, as most frequent visitors know, is a fairly reliable top signal. It needs to stay above the trend line tomorrow to confirm though, so also argues, what I mentioned above, that bulls must have a decisive breakout tomorrow, otherwise it’s not only a confirmation of a bearish chart pattern but also a very reliable top signal.

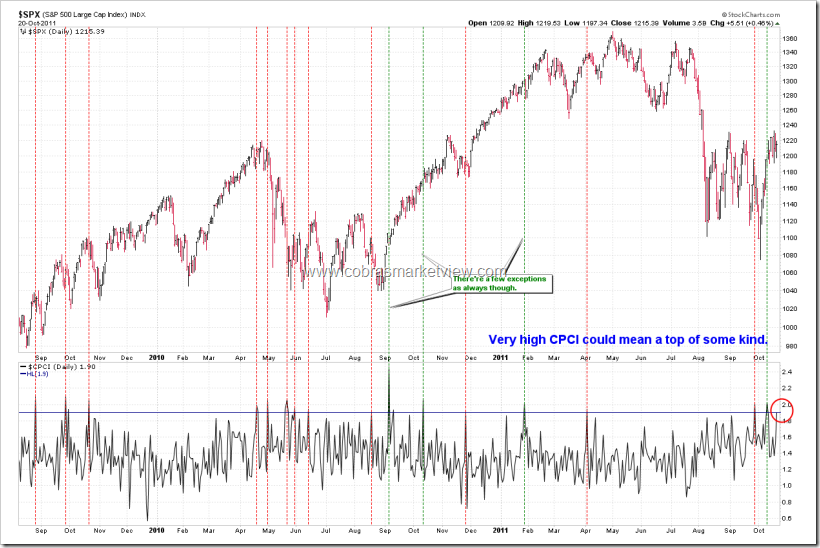

- CPCI is too high, implying that big guys knew something we don’t therefore have their positions well hedged in anticipation of pretty bad things. The chart below proves these guys are right, even those 4 failed exceptions, 3 of them still seen a pullback of some kind soon.

- VIX keeps having higher high. The divergence between VIX and SPX are simply too large, well worth close attention.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BEARISH FRIDAY

According to Stock Trader’s Almanac, October expiration day, Dow down 5 straight and 6 of last 7.

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: IN WAIT AND SEE MODE

有可能到顶了(至少短期),或者非常接近了。当然今天的证据都跟option有关,明天又是OE Day,所以可能不足为凭,也因此下面的图说明了明天的看点,牛牛需要个决定性的突破,不成功的话,就很可能确认了下图所指的两个bearish图形:3 Push Up or Diamond Top。

下面谈谈看顶的理由:

- CPCE破了经过3点确认的trend line,老读者都知道,这个是相当可靠的顶部信号,当然需要明天保持在trend line以上来确认。这个也说明明天牛牛只许成功不许失败,因为失败的话,不仅仅是bearish pattern确认,同时也是顶部信号的确认。

- CPCI太高,表示大户知道些我们不知道的事情,因此提前作了最坏的打算。这个图,既使是4个例外的情况,其中3个也是有不同程度的回调的,换句话说,今天收盘做空的熊熊,至少还有逃命的机会。

- VIX继续higher high,这个divergence的程度比较大了,值得注意。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY BUT MAINTAIN SPX DOWNSIDE TARGET AT 1,000

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details.

SEASONALITY: BEARISH FRIDAY

According to Stock Trader’s Almanac, October expiration day, Dow down 5 straight and 6 of last 7.

See 09/30 Market Outlook for October day to day seasonality chart.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Dr. Copper and TED telling us not very pleasant things either…

That’s perhaps for longer term. We guys here mostly don’t care a little longer than a week. 🙂

Cobra: you know us like a book because anything that is longer than a week term, account could already be blown out, LOL

by the way, like previous comments, I think your report is simplistic , concise and even newbie like me can understand clearly. You re special, Cobra, a very special man. You ever consider starting a charting school and TA? people like me find information in your report very informative and if use wisely can be beneficial. So as always, THANK YOU for your hard work.

Thanks for the kind words. 🙂

Great report as always. Thanks!

very concise, and direct report. enjoyable to read, and read in under 5 minutes – a sign of something really well done.

Thanks for your great work!

Thanks a lot.

Thanks for a great report.

Could you tell us what it would take to reverse the long signal on the Impulse System?

Weakening in breadth.

The VIX has failed res of crossing 21MA & 38MA. Shooting star and rising wedge. Ist this something to watch? Thank you.

It is something to watch, but not a strong sign yet.

Okay all you queermo’s…nothings changed 11650 still resistance 11225 still support….we probably will see a move down to 11225 before a break above 11650…but at least you know where to place you bets and stop losses. That is really all you need to trade. Place your bets are critical price points and manage from there.

thanks, Cobra

THX!!!

Cobra before you inevitably start charging for your market recaps you should consider a donation button and see how that does. Then you will truly see just how grateful all the Cobra lovers are! 🙂

I think we all here had told him that. But, for some reason I can’t see, he doesn’t like that option… But I guess we can “donate” something by other way.

Thanks. But the problem is, say you donated some money, but later I start to charge, you’d feel unfair because you already paid. So if I accept the donation, then this could mean I shut down the door for a fixed fee.

Thanks.

Some new here, good time to learn. I appreciate your analysis and insight.

thanks cobra laoda

Thanks Cobra for your posts. I have been a lurker here (the blogger site) for about 2 years with a few posts. I always appreciate your insight. Just thought I would say Thank you for your hard work.

Thanks 🙂