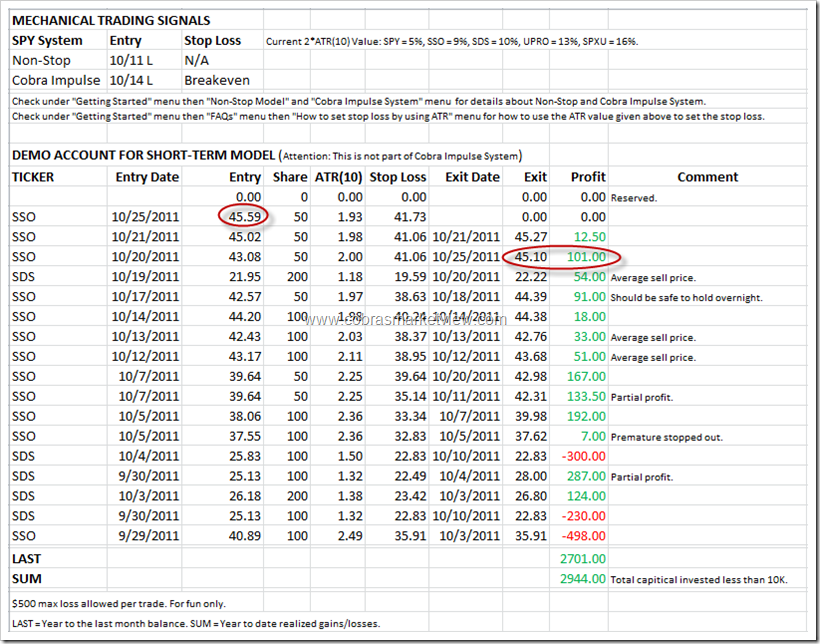

SHORT-TERM MODEL NOT SURE IF THE TREND IS DOWN NOW, HOLDING TRAPPED LONG POSITION OVERNIGHT

The bottom line, the market had no 2 consecutive down days in October, so let’s see if bears can finally break the rule tomorrow, otherwise, still is the old saying, one day dose not make a trend, therefore it’s nothing today.

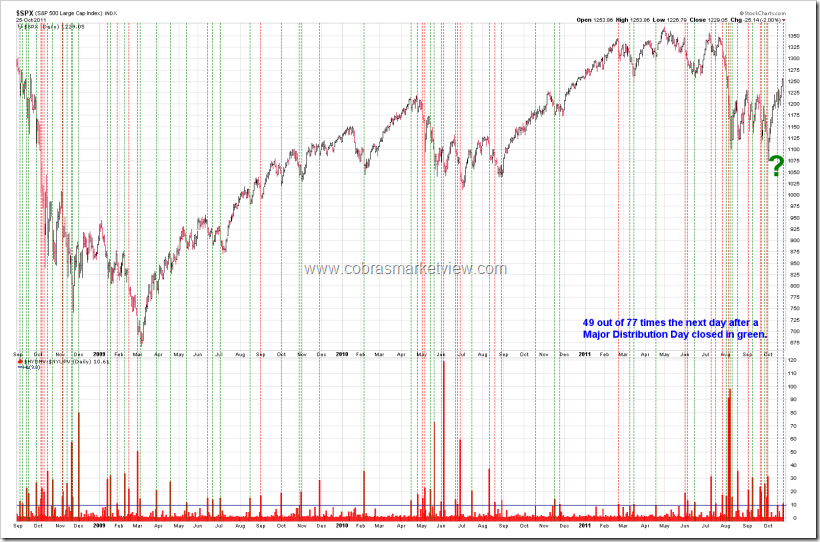

A little little bullish biased (64% chances) toward tomorrow because today is a Major Distribution Day.

Hi Cobra, have you looked at the global dow this week?

http://stockcharts.com/h-sc/ui?s=$GDOW&p=D&yr=0&mn=8&dy=0&id=p92032946418&a=246886698&listNum=115

and

http://stockcharts.com/h-sc/ui?s=$GDOW&p=M&yr=11&mn=11&dy=15&id=p75449152905&a=246796376&listNum=115

and

http://stockcharts.com/h-sc/ui?s=$GDOW&p=W&yr=3&mn=2&dy=0&id=p54315284158&a=246796403&listNum=115

good trading, Rob

What do you imply? US could lead the global market or would be dragged down by the global market.

That’s always the $64,000 question. 😉

I say the global market gets dragged up. 🙂

Cobra, love it when you get definitive, like the move down call based on NYMO today. Your money in the bank , my friend, I know you posted how far this short term drop maybe, but can you just repeat the SPX target. Does anyone know what time the BIG ANNOUNCEMENT from the E.U .SUMMIT IS?

See tonight’s report. I only know how far the 1st down leg would go.

I look to believe it or not the Russell and NYSE , Global Dow is a tell and this is it’s 1st serious divergence , this is the 150 leader corporations around the world,

http://en.wikipedia.org/wiki/The_Global_Dow The ssec is getting hammered in bear cycle but is oversold.http://stockcharts.com/h-sc/ui?s=$SSEC&p=M&yr=12&mn=0&dy=15&id=p07992350685&a=246912334&listNum=115India is a better leader ,(to me), it’s in a bear cycle, but is oversold as well,http://stockcharts.com/h-sc/ui?s=$BSE&p=M&yr=12&mn=0&dy=15&id=p07720884322&a=246912328&listNum=115today the market was slightly weak, and gold rallied $50 If the U.S. is in a bear market it’s following the rest, the more important question is why is india and the shanghai exchanges tanking? Who do they rely on to buy their goods, 1st usa, 2nd every one else. Trouble for India and china , is felt from europe and usa weakness, india and china are the canary . Gold is signaling real fear. USA is lagging these indicators, can it hang on and avoid the weakness extreme seen in India and China and Europe? If so that means a short term corrective market , so which market would have the furthest corrective rally?????? Not USA

good trading, Rob

Thanks. But China was up huge in the past 2 days. I do China market report too, by the way. 🙂 I don’t mean disagree with you, I tend to believe US would follow the world. I just want to hear your reasoning. Thanks again.

SP500 Fibo…

http://astrofibo.blogspot.com/2011/10/sp500-fibo_25.html

thx,ding

Finished.

http://img508.imageshack.us/img508/2531/spxnymo241011pubf.jpg

Excellent chart! Thank you very much for this masterpiece of analysis. In the last weeks, I’ve also traced back that bullish divergences on NYSI, but your chart represents all-in-one. 🙂

Thanks. Nice to know that it’s of value!

This is a great chart HighRev, thanks. But I’d like to point out one “weakness”. The period we are looking at is a bull run, have you tested these indicators in the 2000 – 2003 period, or 2007 – 2009?

I have limited historical data, but it looks to me like the 1998 and 2002-2003 lows had bullish divergences on the NYSI that proved to be very rewarding for longs initiated at the Early Buy and Buy Spike stages. Early 2008 had a couple of bullish divergences (one longer term after a shorter term bullish divergence failed), both of which eventually failed (one with minimal losses and the other basically breakeven), BUT, and this is a big BUT, I don’t think you could have made the case for a valid buy signal in either case (at best you could have argued an Early Buy on the second setup IMO).

ASTRO High October 25th 07h20…

http://astrofibo.blogspot.com/2011/10/astro-high-october-25th-07h20.html

THX!!!

ASTRO Next Lower Low

http://astrofibo.blogspot.com/2011/10/astro-next-lower-low.html

Cobra,

If I remember correct, an MDD almost guarantees an intra-day low the next day, at least recently.

Thx

DJI Fibo…

http://astrofibo.blogspot.com/2011/10/dji-fibo_25.html

Bullish percentages look toppish, but they are still rising: BPNYA +1.02%, BPCOMPQ +0.60%, BPNDX +1.52%, BPSPX +0.86%, BPINDU & BPOEX are flat,

I think you are correct on the call for tomorrow! Also, this little move down does not signal the end of the bull leg up to maybe 1330 or so. Great work you are doing!

Dax Fibo…

http://astrofibo.blogspot.com/2011/10/dax-fibo_25.html

I’m seeing trend change signals on the hourly in RSI, SMI Ergotic and Dtrended Oscillator….I’m now in ERY, FAZ and SQQQ. Gold is showing fear and with the world market instability, I feel better about these short bets–for now.