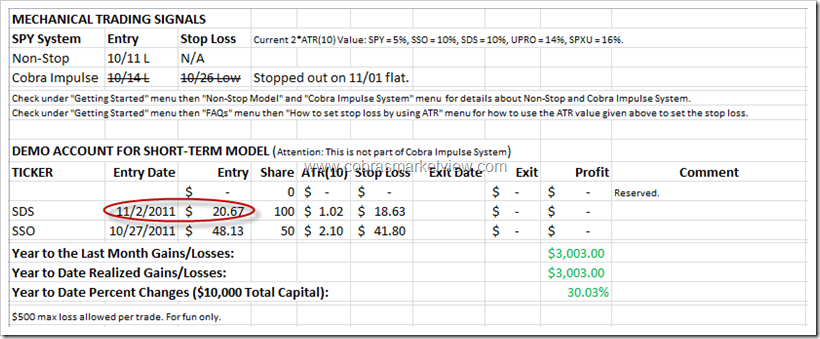

SHORT-TERM MODEL BELIEVES THE TREND IS DOWN, HODING BOTH LONG (TRAPPED) AND SHORT OVERNIGHT

The bottom line, I’m clueless, well, as always.

Based on the statistics of VIX rose 38%+ in 2 days, we got the promised green day today. Then when VIX rose 38%+ in 2 days and SPY closed in green on the 3rd day, what the crystal ball says the 4th day, i.e. tomorrow? Well, not so bull friendly especially the Gain/Loss ratio. The samples are too small, so I won’t read too much into it, for fun, because I really need find something to say ![]() .

.

Since its inception,when EDC gained >8% in a day, next day open is lower (61%) and low is lower than today’s close 84% of time. Disclosure: Long EDZ

Since its inception,when EDC gained >8% in a day, next day open is

lower (61%) and low is lower than today’s close 84% of time. Disclosure: Long EDZ

I have to admit that I think I was early in reminding everyone about my NYSI analysis. That buy spike may still be a way off.

GOLD Time Ratio…

http://astrofibo.blogspot.com/2011/11/xauusd-time-ratio.html

DJI Fibo…

http://astrofibo.blogspot.com/2011/11/dji-fibo.html

EURUSD Time Ratio…

http://astrofibo.blogspot.com/2011/11/eurusd-time-ratio.html

Hi Cobra,

your “Contact Us” page doesn’t seem to work.

I’m back and posting again, so I’d appreciate if you could put me on your blogroll again.

Thanks a lot.

Frank

http://www.tradingtheodds.com

check you email at tradingtheodds.

This is what I’ve been looking at.

Chart 1 = DOW 2007 bull market top and subsequent 7 Month retrace to trend line backtest.

Chart 2 = DOW 2011 market top and subsequent 7 Month retrace to trend line backtest.

Chart 3 = Same chart, 3 days later.

All charts are 24 hour inc. Globex.

Thanks, nice chart!

I would think the patterns will be alot more complicated than spring of 2008. Great analog so far though. However, I expect a monkey wrench to be thrown in there with ESFS and prospect for QE3. Means dealying the chart some. In fact May 2010-July 2010 was an April 2008 analog as well until…. QE2. There are too many looking at this 08 analog right now. Everyone can’t be right.

Although I agree with you – there’s nothing worse than missing out on a great move where you absolutely nailed the top. Done that a few times!

So, I approach it with a strategy, take the position, close half when you have reached an initial support you are happy with, then run the stop loss on the 2nd half just above the trendline in case of a 2nd re-test.

Alternatively, trail the stop loss from the outset and let the whole position get stopped out for a fair overall profit if price starts to rally again.

I tend to use the first option. If the 2nd half of the trade doesn’t get stopped out, I would then look to add to the short position on the next swing high, therefore re-instating the original position size. It’s always harder in practice than it is in theory though.

Thanks!

And who gets away with this jungle?The price. It is necessary to follow him.http://spx500.blogspot.com/

thx,ding

NAS Update Time Ratio…Fibo…

http://astrofibo.blogspot.com/2011/11/nas-fibo.html

Bullish percentages: BPNYA up 0.34%, BPCOMPQ up 0.18%, BPNDX down 2.94%, BPSPX down 1.15%, BPOEX and BPINDU flat.

Not clear if bullish percentages are showing a top or are breaking out to higher highs.

For a change here a look at the NYSE summation index, which shows a similar pattern to BP charts.

Here NYSE summation:

Hopefully it is a bull trap

Wayne, one of the best indicators is medium term momentum, and on NYSE/SPX it’s pointing upwards. Short term mom is pointing down, but in general medium term momentum wins. Medium term momentum is not a precise indicator, but when it’s pointing up I don’t bet against it unless market is extremely overbought and I play intraday.

Other signals which support this view are the position of the daily 377 MA providing support at 1215 and the P&F Rubicon at 1200…In other words: shorting here is kind of risky and short term the odds don’t favor the bears

Cobra: Like you I am bearish. Also, ES 2hr seems bearish so far.

Tomorrow we will have a black day. Greek powered. In this scenario, CDs will we executed, several worldwide economical institutions will fail, and probably a couple more of countries. A chain reaction almost imposible to stop. That’s my opinion.