Because:

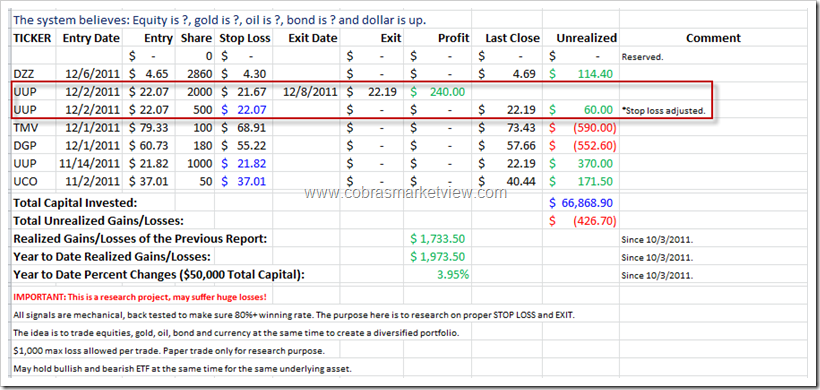

- UUP daily bar low is above the entry price.

- It’s a pyramid position.

- It takes too much margin.

- The system will try to be on the bearish side tomorrow, therefore no more bearish hedges are needed.

So out the most of the UUP position and set the breakeven stop loss for the rest. In the real world trading, you can either short 6E (futures) or long EUO (2x short euro) instead of buying UUP, so in this way, it won’t take much capital. Also the 3x UUP is UUPT and the 3x UDN is UDNT, just the volume is too thin, you might not want to use buy stop order on them.

The system will try to short Russell 2000 tomorrow. Set TZA buy stop at $29.71, stop loss around $25.64.

The system will try to long bond tomorrow. Set TMF buy stop at $68.75, stop loss around $60.68.

The system will try to short oil tomorrow. Set SCO buy stop at $40.26, stop loss around $36.71. If SCO buy order filled, then close the current UCO position.