HIGHLIGHTS:

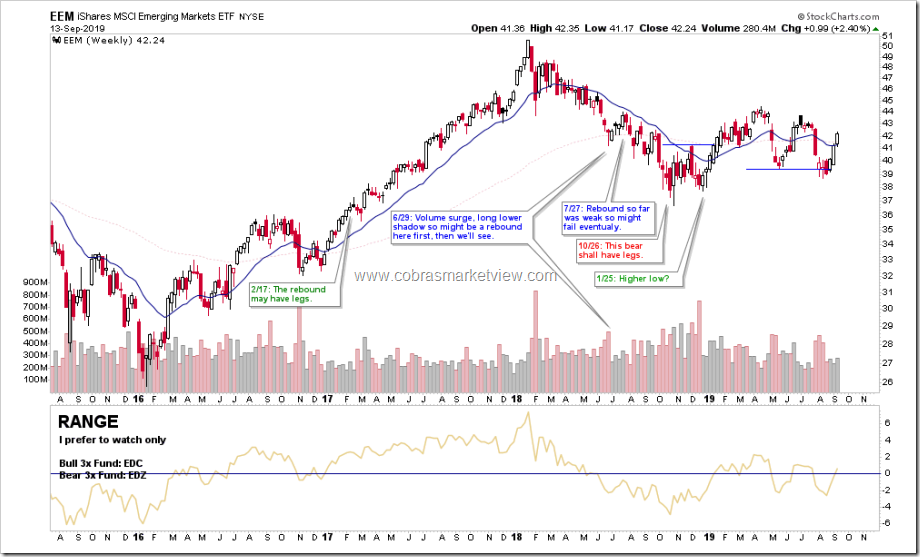

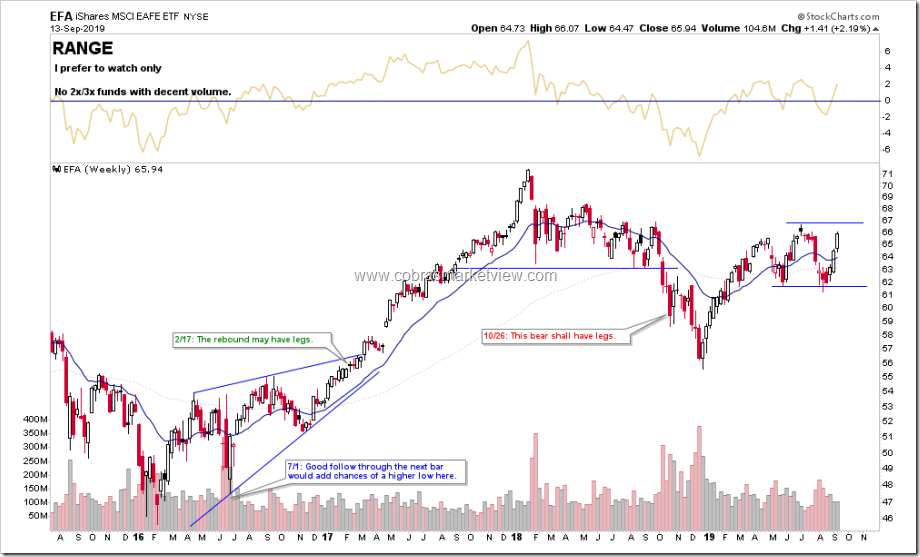

- 09/13: EEM, EFA, XLF, 2 strong bull bars in a row, watch for potential trend changes.

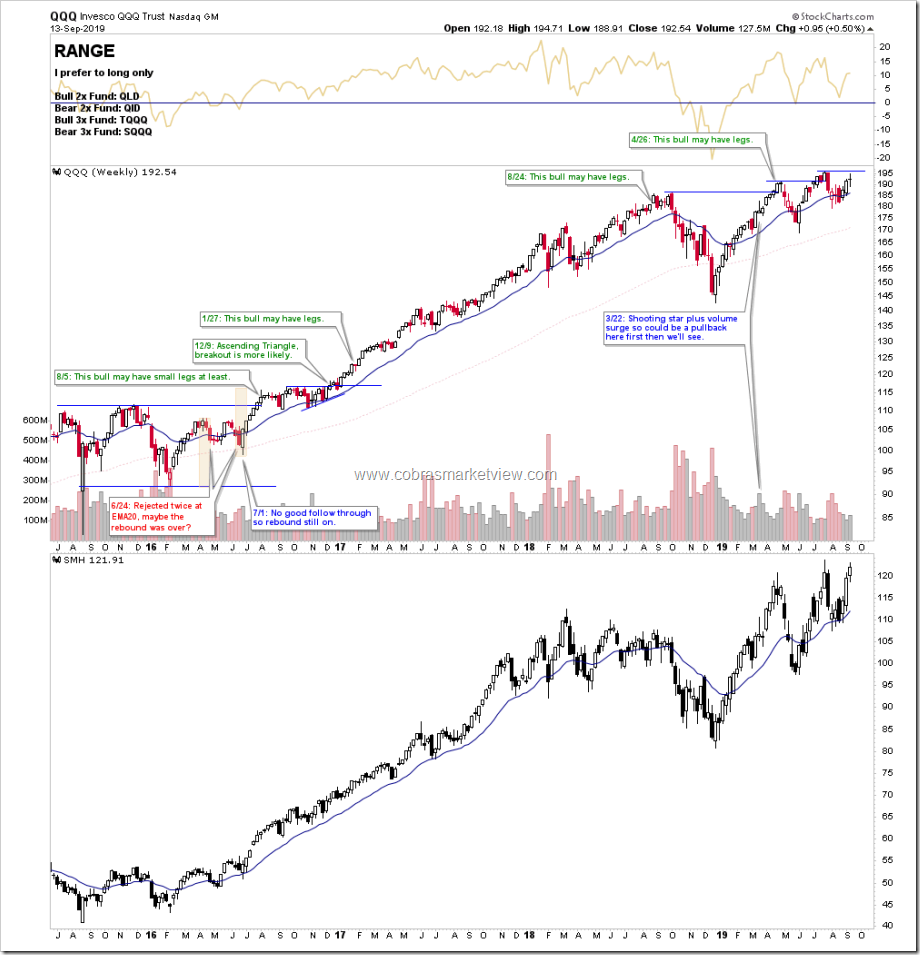

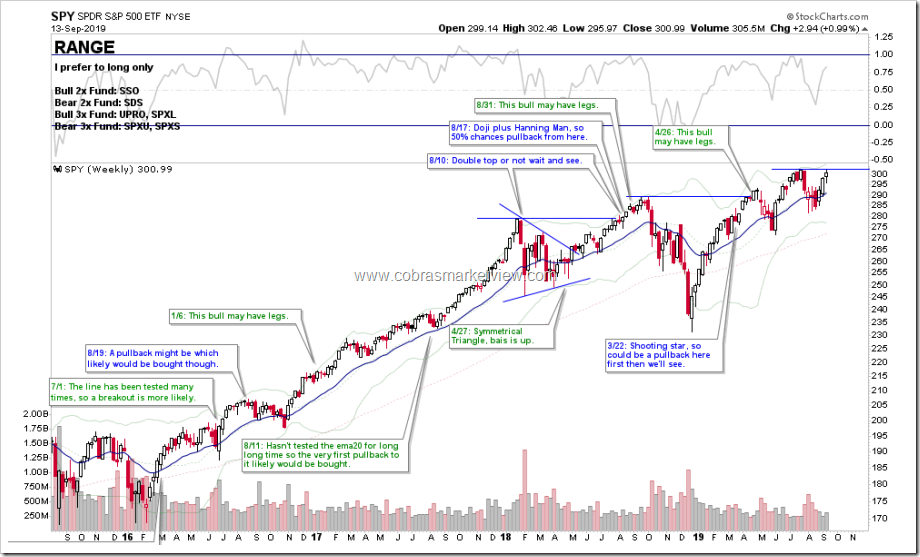

- 09/13: SPY, QQQ, IWM, AAPL, BABA, XLF, testing the previous high, key time.

- 09/06: UNG, the rebound may have legs, bears need wait.

08/30: GDX, AAPL, testing the previous high, key time.- 08/30: UUP, this bull shall have legs. Updated to UPTREND.

- 08/23: UNG, this bear shall have legs.

- 08/02:

IWM,AAPL, GOOGL, AMZN, FB, NFLX,BABA,EEM,EFA,XLF, beware of lower high. Need strong bear follow through next week. - 08/02: GDX, this bull shall have legs.

07/05: AMZN, NFLX, XIU.TO, breakout should be more likely.- 06/28: GLD, this bull shall have legs, upgraded to UPTREND.

- 05/24: TLT, this bull shall have legs. Upgraded to UPTREND.

- 02/08: IYR, this bull shall have legs. Upgraded to UPTREND.

For other featured ETFs not posted below, it means no changes. You can find all the charts HERE. Chart starts from 3.1.0.

EEM, EFA, XLF, 2 strong bull bars in a row, watch for potential trend changes.

SPY, QQQ, IWM, AAPL, BABA, XLF, testing the previous high, key time.

HOW TO USE MY COMMENTS:

- This report is suitable for longer term investment style. The analysis is on the weekly chart, so will update every Friday. If you only do long term investment, you will need only check this report once a week.

- Not recommend using leveraged 2x or 3x fund if you intend to hold for years. Those 2x or 3x funds have time decay.

- Check HERE for what I mean this bull or bear has legs. Or I say rebound/pullback maybe but likely it’d fail. Or I say this pullback/rebound likely would be bought/sold. This is the most useful comment because I must be sure about the trend, so as soon as you see this comment, you know you have at least one chance to buy dip or sell bounce. For general way of buy dip/sell bounce, check H1/L1 setup.

- Breakout/Breakdown is likely, is another useful comment. Just long above breakout point or short below breakdown point. For general way of buy breakout/breakdown, check Base and Breakout setup.

- When I say 40% chances of double bottom/double top, I’m talking about potential Trading Reversals setup. If you’re very disciplined, you can try the reversal trade but you should know the winning rate is just 40%, so your target must be at least 2x of your stop loss size. If you don’t understand what I’m saying here, then obviously the Trading Reversals setup is not for you.

- This report covers the following stocks/ETF:

- Indices: SPY, QQQ, IWM

- Sectors: XLE, XLF, IBB, IYR.

- Commodities: USO, GLD, GDX, UNG

- Bonds: TLT, JNK

- Internationals: EEM, EFA, XIU.TO, ASHR, $DAX

- Currency: UUP (FXY – share the same chart with UUP).

- Stocks: AMZN, AAPL, NFLX, BABA, FB, GOOGL, TWTR, TSLA