According to the weekend market recap, today is counted as day 2, so tomorrow we may see an intraday reversal but it's hard to guess if the market will close in green. NYADV formed a lower low today, so theoretically SPX should at least have a lower close then today's close ahead. Furthermore, today is the first Major Distribution Day after the last Tuesday's rebound, because Major Distribution Day seldom appears alone, so there should be one or more Major Distribution Days ahead. Therefore, if an intraday reversal happens and the market even closes in green tomorrow, it may just be a rebound.

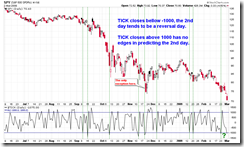

7.0.3 Extreme TICK Readings Watch. Today TICK closed bellow -1000, so the intraday reversal may appear on the next day based on the past observation. This in turn agrees with the wild guess in the weekend report.

1.3.7 Russell 3000 Dominant Price-Volume Relationships. 1443 stocks price down volume up, so the market is even more oversold than last Friday when it had 1155 stocks price down volume up. This is a good news.

0.0.2 SPY Short-term Trading Signals. Lots of oversold signals.

1.0.3 S&P 500 SPDRs (SPY 30 min). The accuracy of RSI oversold on the 30-min chart is pretty high.

In summary, it looks like a rebound is due. However, it might actually be a bad news for bulls, should the market rebounds tomorrow or the day after tomorrow, as it's too easy for bulls, therefore most likely the selling is not over yet. On the other hand, if sell off continues in the next two days, it could be a climax sell and the bottom may be close.

2.4.2 NYSE - Issues Advancing. This chart explains why the NYADV lower low today means SPX will have a lower low ahead.

1.0.5 Major Accumulation/Distribution Days. Major Distribution Day always come in cluster so it's really not a good news to see a Major Distribution Day today.

12 Comments