The market is overbought very short-term, so it may pull back at least tomorrow morning. Short-term, 0.0.4 SPX:CPCE, still "firework-ing", just pay attention to the NYADV at bottom, very close to overbought now. Since CPC is lower than 0.8 today, so according to 7.0.4 Extreme CPC Readings Watch, 68% chances tomorrow may close in green.

0.0.0 Signal Watch and Daily Highlights. Here is the overview of all signals, extremely overbought in very short-term. Well, the most accurate NYADV and NYMO are not overbought yet, so I guess the market still could go up further in the short-term.

Let's "feel" a little bit about how overbought the market is.

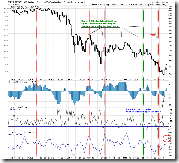

0.0.2 SPY Short-term Trading Signals

1.1.3 QQQQ Short-term Trading Signals. STO is extremely high.

1.0.3 S&P 500 SPDRs (SPY 30 min)

1.1.6 PowerShares QQQ Trust (QQQQ 15 min). This bearish rising wedge looks so obvious, and also be cautious on the negative divergence on ChiOsc.

2.0.0 Volatility Index (Daily). Previously VIX always makes a U-turn when the STO is at the current level, RSI oversold, MA10 ENV oversold and multiple support, therefore VIX may bounce back up. This is no good for the stock market.

14 Comments