Summary:

Still see some no good signs.

May pullback at least tomorrow morning.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Neutral | Some buy signals still need further confirmation. |

| Short-term | Up | Neutral |

Not much to say today, as long as the SPX 878 hold, the uptrend is intact, the game is then to “buy dip”. I still don’t want to bet heavily on the long side though, because:

1. The bond yield keeps rising which now attracts lots of attentions.

2. Semiconductor sector still lags. A little improved today though, but still is on “probation”.

3. From Institutional Buying and Selling Trending (Courtesy of www.stocktiming.com), institutions are not heavily in accumulation as well (and so why we retailers?).

Not sure about tomorrow, probably a pullback at least in the morning.

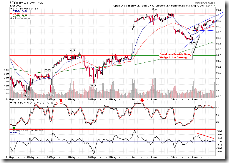

1.1.5 PowerShares QQQ Trust (QQQQ 30 min), STO overbought plus a few negative divergences.

1.0.4 S&P 500 SPDRs (SPY 15 min), could be a Bearish Rising Wedge.

The following charts may need some attentions:

1.1.0 Nasdaq Composite (Daily), SOX is improved today, will keep watching on it.

3.0.0 10Y T-Bill Yield, Symmetrical Triangle, no good for the stock market if breakout on the upside.

5.3.0 Financials Select Sector SPDR (XLF Daily), Symmetrical Triangle too, good for the stock market if breakout on the upside.

6.1.0 Apple, Inc. (AAPL Daily), up 8 days in a row. Yes, technically, up 8 days in a row is not a reason for expecting a pullback, but if one stock rising for 8 straight days, would you buy it? Bet the most people would think the same way, so eventually this stock will pullback. And if so, it’s not good for QQQQ, as AAPL weights more than 10% in QQQQ holdings.

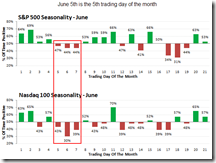

Seasonality from www.sentimentrader.com, the following 3 trading days are not very “bull friendly”.

8 Comments