|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

SEASONALITY: THE MEMORIAL DAY WEEK IS BULLISH BUT JUNE HAS BEEN THE 2ND WORST MONTH OF THE YEAR OVER THE LAST 20 YEARS

See 05/28 Market Recap for more details.

INTERMEDIATE-TERM: MAINTAIN PULLBACK TARGET AROUND 1008 TO 1019, II SURVEY MAY MEAN A HUGE REBOUND AHEAD

Maintain the intermediate-term target around 1008 to 1019 (See 05/21 Market Recap for more details) but since II survey shows too many people are expecting a correction, so if the past II survey pattern repeats again this time, it’s possible that we might see huge rebound, even new high before the real correction kicks in. See 05/28 Market Recap for more details.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: KEY DAY TOMORROW

All eyes are on tomorrow’s Non Farm Payrolls, so it’s a key day tomorrow. See the table above, as mentioned in today’s After Bell Quick Summary, we need an up day tomorrow to confirm the short-term buy signal, and cancel the potential SPY ST Model short setup (assume Close > Open). The chart below shows all Non Farm Payroll days since the March 2009. It seems to me it’s generally bullish and most likely a turning point. So again, key day tomorrow.

About the short-term direction, all I can say is a little bullish biased. Except the reason mentioned above that Non Farm Payroll day was generally bullish, let’s take a look at my old trick the “n vs n” rule below. At least looks to me the down momentum is weaker than the up momentum. Plus, don’t forget the table above, all the bottom signals are still there. So short-term is a little bit bullish biased.

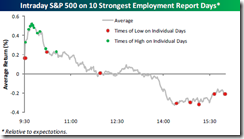

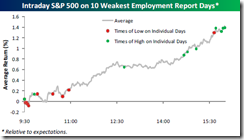

For tomorrow, I just want to remind you of a typical Non Farm Payroll day: Open high generally goes lower while open low generally goes higher. The quote and charts below are from Bespoke:

If Friday’s report comes in strong and the market opens up big, the short-term trade is to sell. If the report

comes in weak and the market opens down, the short-term trade is to buy.