|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

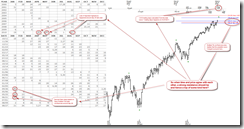

SHORT-TERM: 1-2-3 TREND CHANGE STILL POSSIBLE BUT BEARS HAVE NOT MUCH WIGGLE ROOM LEFT

The new high today is not decisive, so the 1-2-3 trend change pattern still is possible, although there’s not much wiggle room left for bears, especially if another huge up day tomorrow then bears will have to wait for the next lengthy top procedure – pullback then rebound to test the previous high then pullback to a lower low, which in another word is, at least bulls can be safe for awhile.

I’ve been blah blah about the chart below, now both price and time target are finally met AT THE SAME TIME, so a top of some kind should be around, well, in theory. Frankly, I personally won’t read much into this theory, as long as there’s not even an intraday lower low (so called 1-2-3 trend change pattern as mentioned above) formed.

INTERMEDIATE-TERM: IN WAIT AND SEE MODE, WHETHER THE 01/18 HIGHS IS THE WAVE 5 HIGH REMAINS TO BE SEEN

Since even the short-term I have no answer for whether the pullback is over, so whether the intermediate-term was topped, we’ll have to wait and see.

SEASONALITY: THE LAST 2 TRADING DAYS OF EACH MONTH SINCE AUGUST 2009 WERE BEARISH

See 01/21 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/20 S | |

| NDX Weekly | UP | BPNDX is way too overbought. |

| IWM | ||

| IWM Weekly | DOWN | No lower low to confirm yet, but the sell off is strong, so downgrade the trend to down from up. |

| CHINA | ||

| CHINA Weekly | DOWN | |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 01/06 S | |

| XIU.TO Weekly | UP | |

| TLT | 0.2.1 10Y T-Bill Yield: Symmetrical Triangle? So bond should keep falling? | |

| TLT Weekly | ? | |

| FXE | 3.1.1 US Dollar Index Bullish Fund (UUP Daily): 1-2-3 trend change, UUP could be in downtrend. | |

| FXE Weekly | UP | No higher low to confirm yet but the rebound is strong, so I upgrade the trend to up from down. |

| GLD | 1-2-3 trend change, GLD may fall into a downtrend. | |

| GLD Weekly | ? | Testing long term trend line. |

| GDX | 12/17 S | |

| GDX Weekly | DOWN | |

| USO | May fall into a down trend. Could be a Double Top formed on WTIC. Need follow-through. | |

| WTIC Weekly | UP | |

| XLE | 01/25 S | |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | UP | Testing resistance which also is multiple Fib confluences area. |

| IYR | Could be an Ascending Triangle in the forming. | |

| IYR Weekly | UP | |

| XLB | 01/19 S | Testing major trend line and MA(50). |

| XLB Weekly | DOWN | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.