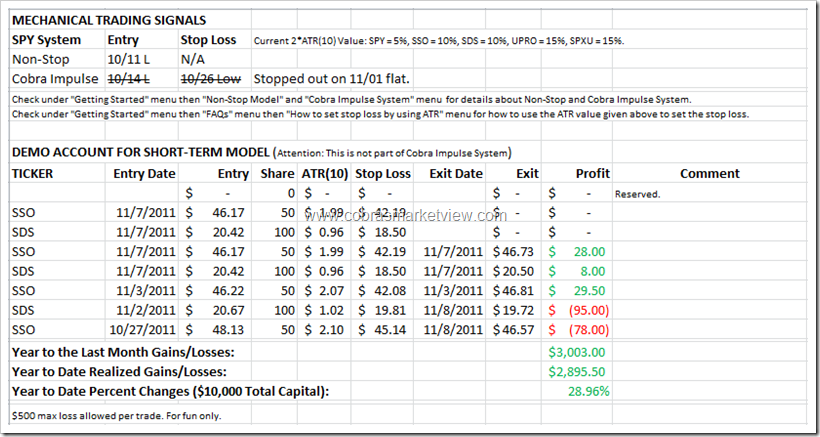

SHORT-TERM MODEL BELIEVES THE TREND IS DOWN, HODING BOTH LONG (TRAPPED) AND SHORT OVERNIGHT

The bottom line, bears finally made an impressive appearance but one day doesn’t make a trend, let’s see whether bears could impress us more in the following days.

A little bullish biased toward tomorrow because VIX rose 30%+ today, buy at close today sell at tomorrow close, you’d have 67% chances since the last 2,000 trading days. I know some people may remember that whenever VIX rose 24%+, 82% chances a green day the next day, but by applying more similar number, which is up 30%, to today’s case, I see less bullishness for tomorrow. My personal preferences are that testing 30%+ might be more appropriate but that’s always your call.

ASTRO Update Decli Speed…

http://astrofibo.blogspot.com/2011/10/astro-update-decli-speed2007-2009-2011.html

ASTRO Update Sun 180 Jupiter…

http://astrofibo.blogspot.com/2011/10/astro-sun-180-jupiter-2000-2011.html

Today, the index looked more bearish than individual stocks (considering the beta etc.) . Let’s see if individual stock can catch up in the following days.

SP500 Update Time Ratio…

http://astrofibo.blogspot.com/2011/11/sp500-time-ratio.html

thx,ding

If taking 1 day at a time, I agree tomorrow is likely to see a little bounce. However, given the overall picture, any bounce here is also highly likely a good short.

Thanks, Cobra!

1214 is a magnet below on ES, so one likely scenario is that it gets tested and holds in the morning before the mkt moves higher.

thanks,

EUR/USD is looking like a small descending triangle on the shorter time frames. It may be enough to support a 100-150 pip downside move if it breaks down. That may lead into some early morning equity weakness – but I think shorts need to be fearful of ECB intervention overnight, especially if the Italian bond issuance is dead in the water. That might be enough impetus for some central bank activity. Bears need to pray that doesn’t happen.