Trading Signals:

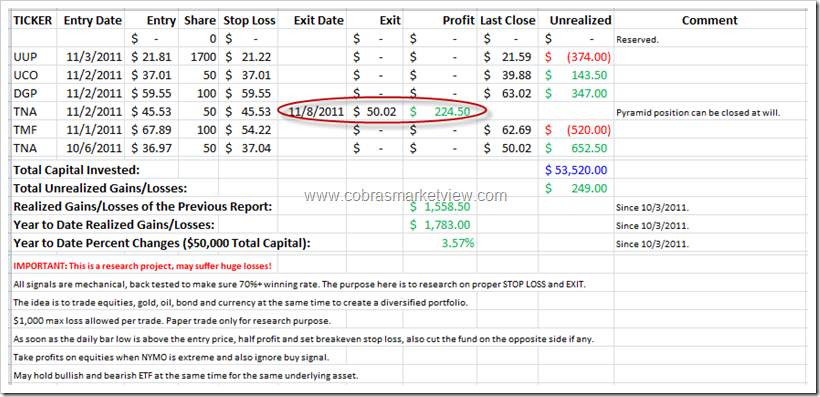

TNA pyramid position was closed today. A pyramid position can be closed at will because the back test shows above 73% winners are flat out due to the breakeven stop loss, so may not be a bad idea to close the pyramid position as soon as a breakeven stop loss can be set upon it.

The system will try to short the dollar tomorrow. Set UDN buy stop at $28.09, stop loss around $27.50. If indeed the buy stop triggered, then cut the current UUP long in half. I’m still not sure if need to cut all the UUP long though. A little logic here is, say:

- Cut half example: Tomorrow I cut half, say lost $250 as the total risk amount is $1000, we’re just half way to the total loss, so cut half now would be only $250 loss, a few days later, say, had to cut UDN half because UUP long triggered again, so lost anther $250, but that’s it, now I hold both UUP and UDN until 1 winner, so the final cut would be another $500. Total $1000 the worst case.

- Cut all example: Tomorrow I cut all, lost $500 as again we’re just half way to the total loss, a few days later, had to cut all UDN because UUP long triggered again, so lost another $500, but the worst case is later I had to cut UUP because UDN long triggered, so yet another $500 cut. Total $1500 in the worst case. But don’t forget, such a nightmare can go on and on, long, cut, short, cut, long, cut, short cut until forever, well, in theory.

- Think the worst case won’t happen? Well, trust me, it’s the reality more often than not, otherwise how come the most trend following system has only 40% winning rate? The good point for cutting half is – long, cut half, short, cut half, that’s the max cut, and since you now hold both long and short, you basically ignore all the following setups until you have a winner.

- Then what if no cut at all until you have a winner? Well, that’d be $1000 losses, no matter what. But comparing the better case, say, UDN tomorrow were eventually proven correct, since already cut $250 UUP so the final loss for the other half UUP would be $500, total $750, a little cheaper than $1000, right? And in reality because of gap, more likely you cut far below your stop loss price so maybe a 50% early cut is not a very bad idea?

Any logic error above? Comments are welcome.

NAS Important Time Ratio…

http://astrofibo.blogspot.com/2011/11/nas-important-time-ratio.html

SP500 Update Time Ratio…

http://astrofibo.blogspot.com/2011/11/sp500-time-ratio.html

ASTRO Moon Cycle…

http://astrofibo.blogspot.com/2011/11/moon-cycle.html