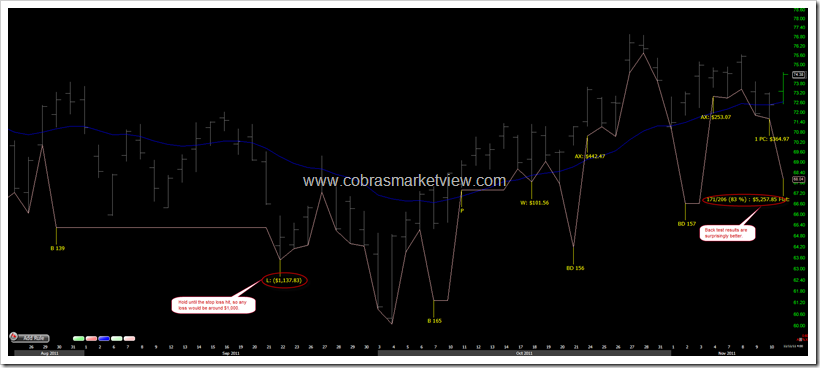

In 11/08 Portfolio Update, I discussed the idea of cutting half position when the opposite setup is triggered. The following test is my 3 full days programming (and not yet finished, it’s the back test for the system used for the daily portfolio report), looks like the cut is not necessary rather it’s a bad idea.

The 1st chart shows the result of not cutting half, instead let the stop loss work, the winning rate was 86% and use $1,000 as the max stop loss amount, long only IWM since the last 2,000 trading days, the total profit would be $5,257.85.

The 2nd chart shows the result of cutting half when the opposite setup is triggered. The winning rate was 68% and use $1,000 as the max stop loss amount, long only IWM since the last 2,000 trading days, the total profit would be $3,547.97 which is far less than not cutting half.

I think the reason not cutting performed better is because IWM tends to produce lots of false signals, so by not cutting half, the system essentially ignored all the whipsaws. By the way, since cutting half didn’t work, so it’s unnecessary to mention cutting all here, the performance was far worse.

ASTRO Update Moon Cycle…

http://astrofibo.blogspot.com/2011/11/astro-moon-cycle_14.html