SHORT-TERM: MONDAY MIGHT BE THE KEY DAY

First of all, take a little time to vote. The intraday forum has above 1K registered IDs (all had passed the test proving to be traders with good stock market knowledge), but usually around just a hundred is willing to vote, that’s a little bit low.

Officially now both intermediate-term and short-term are up (see table at the end of this report before the Chinese Transcript). In addition, bulls have 2 more good news:

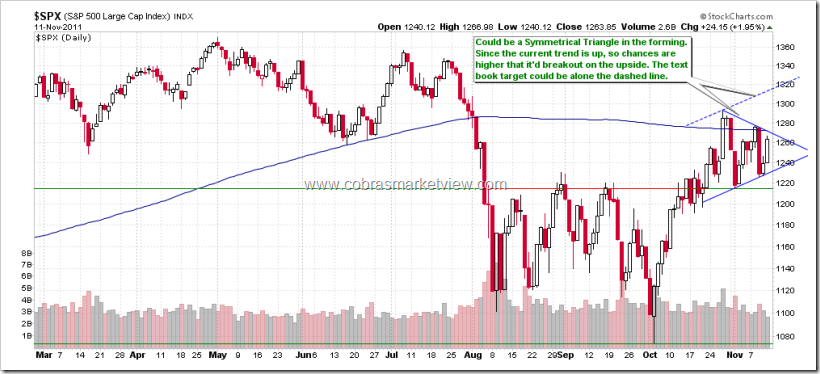

- Could be a Symmetrical Triangle in the forming on the SPX daily chart therefore chances are high it’ll continue up from here.

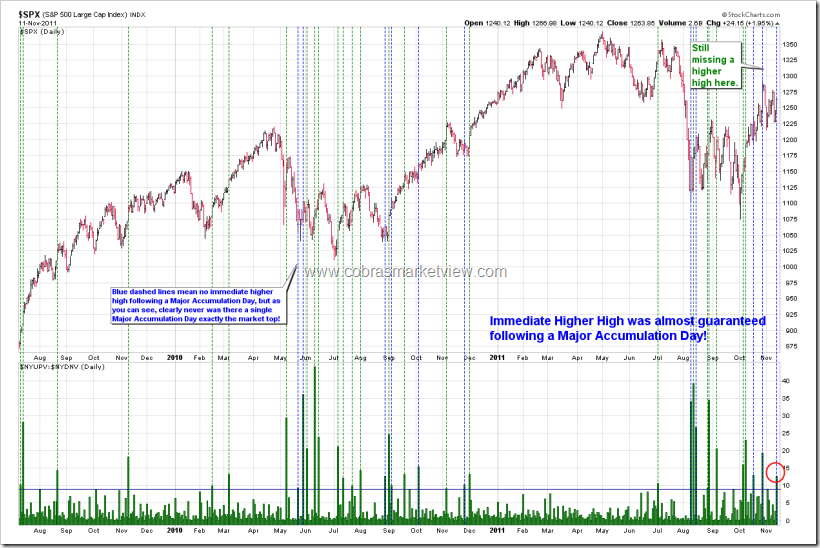

- Because Friday is a Major Accumulation Day, so basically it guarantees a higher high Monday.

So if this is a football match, now bulls got the ball and are attacking. The bear’s hopes rely on the following 2 charts, which I’d say 50 to 50 chances.

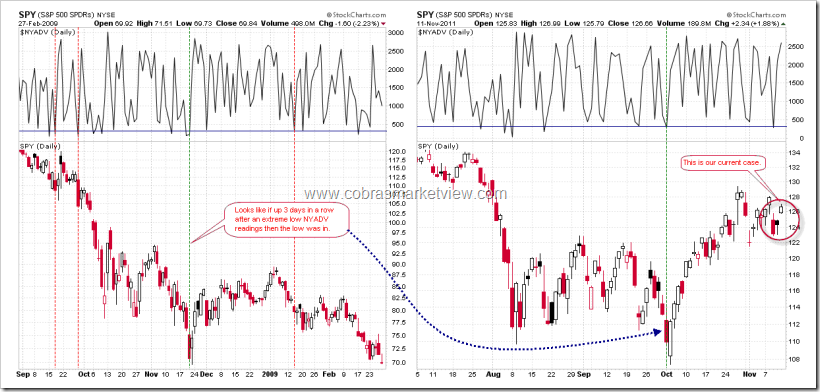

- As mentioned in the 11/09 Market Outlook, because NYADV closed too low so most likely a lower close ahead. But instead of lower close, SPX rose 2 consecutive days thereafter. The question now is: Was the lower close ahead dead? The chart below shows all the cases when NYADV closed extremely low and SPX rose 2 days in a row thereafter. Clearly we can see, the next Monday is the key, another up day would mean no lower close ahead.

- The chart below is the bear’s 2nd hope: Although up 2 days in a row and neither were small, the money flow however is negative. This is very similar to what happened from Oct 26 to Oct 28, so if up Monday again with another negative money flow, (perfectly) with even larger money outflow, then be careful of the famous “Turnaround Tuesday”.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY, WILL NEED REASSESS SPX 1,000 DOWNSIDE TARGET

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details. I’m not sure about this call anymore, will need more evidences to reassess.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: MONDAY MIGHT BE THE KEY DAY

先提醒一下,别忘了投票哈。

Officially中期和短期现在都是up。牛牛目前有两个好消息:

- SPX daily图上看着是个Symmetrical Triangle,因此continue up的可能性比较大。

- 由于周五是Major Accumulation Day,因此基本上guarantee周一会有higher high。

如果用足球比赛做比喻的话,现在是牛牛得球,在进攻中。熊熊的希望在于下面两幅图,胜算都不高,50%吧。

- 我在11/09 Market Outlook里提到了NYADV too low,往往意味着lower close ahead。但是此后SPX却连涨两天,那么是不是这个lower close ahead就无效了呢?下面的图是NYADV extremely low以后SPX又连涨两天的情况。可以看到,周一是key,如果再涨的话,大概就没有lower close了。

- 下面的图是熊熊的第二个希望,虽然连涨两天,幅度都不小,可是资金却是净流出,其情形非常类似10月26号到10月28号的情况。所以,如果周一又涨,但是还是资金尽流出,且比本周五还大的话,小心turnaround Tuesday。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY, WILL NEED REASSESS SPX 1,000 DOWNSIDE TARGET

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details. I’m not sure about this call anymore, will need more evidences to reassess.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

thx,ding

Thanks Cobra,

This time, you are bull-biased. 🙂

No, you read wrong. Bull biased never bother to say NYADV and money flow cases because they’re just 50 to 50 chances.

Cobra, All the news flow this weekend is bull biased. So definitely the ES and S&P will up again tomorrow morning along with the overnight asian markets since Friday was up huge in Europe and US. But it appears that you are not totally in the bull camp for the next market move – you are 50-50 waiting to see what happens after the higher market open on Monday. I am correct in my interpretation?

Thanks.

Yes, I believe gap up open the next Monday, the question is how the market cloces.

Thanks, Cobra!

Low volume on up days is a sign of a low bull conviction. This mkt is driven up by weak hands. But seasonality plays in their favour so SPX rising on fumes to 1300+ is entirely possible.

For the past 2 years, volume doesn’t matter at all, so I won’t read too much into the low volume Friday.

exactly, vol doesn’t matter.

Still not all that bad. 😉

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&b=5&g=0&id=p69856188171

just bought two more books in amazon… cobra ,, so we retest the highs of october . you said depending how we test those highs would be very telling….

Thanks for support me via shopping at Amazon.

How r the rydex flows looking? Still ultra bullish (contrarian bearish)?

ultra bullish.

Go Browns!!!!!

I’ve never seen such an inept football team. Painful to watch. Absolutely painful.

SP500 Time Ratio…

http://astrofibo.blogspot.com/2011/11/sp500-may-november-time-ratio.html

Thank you for all the great analysis.

Hopefully one day us Earth people can also retire, on Mars, with a yacht!! 🙂

LOL

Cobra:

Can you please explain the concept of money flow being negative when market is up? I just cant understand how market can be up when money is flowing out of market, especially two up days in a row.

The StockCharts ChartSchool is a great resource. http://stockcharts.com/school/doku.php?id=chart_school

http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:chaikin_money_flow_c

http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:money_flow_index_mfi

http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:on_balance_volume_ob (This on a tick by tick basis is the best IMO.)

http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:accumulation_distrib

HighRev: Thanks for sharing knowledge. Really appreciate that.

Great thanks.

HighRev has explained well.

My understand is lots of transaction happens on the down tick. That’s how WSJ calculates the money flow. It means someone is selling into the strength. But like HighRev said, it’s not always bad because it might be just one big guy’s selling and chances are he may sell too early.

Lots of great data here. http://www.zerohedge.com/news/weekly-chartology-investors-uncertain-about-lower-uncertainty

Once in a while I’ve got to give ZH a thumbs up. 😉

I’m slightly bullish for Monday, daily momentum is turning up and there’s this triangle on the daily. But the general uncertainity makes me focus on small market moves. A small 30 min chart helps me: it does not give any indication of the general direction, but it shows support and resistance very precisely, e.g. if 1265/68 breaks market will rise to 1275, if 1275 breaks market will rise to the 1285ish area. I’ve been testing it last week and so far its performance was flawless…

RUT Fibo…

http://astrofibo.blogspot.com/2011/11/rut-fibo.html

Weekend bigger picture update

http://heavenskrowinvestments.blogspot.com/2011/11/weekend-update.html

ASTRO Saturn 23 degree…

http://astrofibo.blogspot.com/2011/11/astro-saturn-23-degree.html

NAS Fibo…

http://astrofibo.blogspot.com/2011/11/nas-fibo_13.html

Cobra, have you got the latest institiutional buying and selling chart?

Cobra, have you got latest institutional buying and selling chart?

sorry, didn’t mean to repeat myself….

A little negative divergence.

Cobra,Thought you would be interested in the following – key points:Monday had been the high of the week for the last three November opex weeks.Friday or Monday after Thanksgiving has been a low for the past 4 holiday periods.All the best!-D*****************************************************While October was a bit disappointing in terms of opex drama –

no major lows and just that minor top on the Monday after opex, here is

another month, that has had its share of opex drama – also,

Thanksgiving has been a very significant turning point

that no one really discusses. Specifically, the Monday after

Thanksgiving, though in 2009 it was the Friday – thanks to Dubai!)

Anyway, here are the main points for you to be aware of for this

month:

-Last year in November we had an opex Tuesday low and then a low the Monday after Thanksgiving

-2009 – the structure was different, but we slid all week till opex Friday…. bounced and then had the CRAZY Dubai bottom

-2008 – The MASSIVE low on Opex Friday and then the huge down day and LOW on the Monday after Thanksgiving

-2007 – was in many ways an outlier, but should not be discounted….

as the market fell from 31-Oct in to Opex had a strong bounce from Mon

to Wed of opex and then fell hard till the Monday after Thanksgiving….

-2006 – nothing special, though it was the Tuesday after Thanksgiving that provided a small dip to buy

-2005

– BIG October opex bottom and then a good run in to Thanksgiving before

stalling and doing nothing for the rest of the year – ie. did not really work this year

-2004 – Wed opex top and a minor low on the Monday after Thanksgiving (that was not violated until Jan opex)

-2003 – Friday of opex week low (which was your last buying opportunity below SPX 1050 until 2008 – Thanksgiving play did not work

-2002 – Wednesday of Opex week low, then a strong rally that peaked the

Monday after Thanksgiving, which was the last chance to sell until the final low in March 2003

I must admit that

the 2002 analog is one I will follow closely for a little while, as it had the

very strong October bounce as well, so I will be watching it more carefully…

2001 – A minor top the Monday after opex and then a minor top the Tuesday after Thanksgiving

2000

– This was a rare Monday of opex week bottom (very infrequent) and

then a decent top the Monday after Thanksgiving (good for close to 70

SPX points)

1999 – This was another year where

we had a very significant October opex bottom – the market then rallied

strongly in to November and had a small double top on the Thursday of

Opex and the Monday after opex and then the lows for the rest of the

year occurred on the Tuesday after Thanksgiving

1998 – (the last year I have studied) – Here again we had a very powerful October bottom and a market that screamed higher until the Friday after Thanksgiving

when it

then spent a few weeks consolidating making a major low (again a rare

one) on the Monday of Opex week in December. Opex week in November was

quiet with a strong upward bias…. the market then hit a wall of

resistance around 1193 SPX on the Monday after Opex that was just

slightly exceeded on the Tuesday and the Friday of Thanksgiving week.

Overall,

November opex has been an ok, but not a great month for turning points –

hitting a market extreme around Thanksgiving, particularly, but not

always the Monday after Thanksgiving has worked every year with the

exception of 2003.

My basic guide for opex is

hourly OB on the Wed, Thurs and Fri of opex week is a good sell. Hourly

OS on the Tues, Wed and Fri of opex week are very good buys (for some

reason the Thursday of opex week does not work that well for buying

hourly OS, though it did work in October and January of this year –

there are a few

times you would have been mauled!) The last opex period that did not

provide a good hourly signal was Dec 2010 and the last time taking the signals would have hurt you is Aug of 2009 – though there were a few times where you felt pain for a little while taking the signals (eg April 2010 and May of 2011 – though both worked well with bottoms occuring the week after opex)

Then

post opex, there are frequent tops the Monday (and occasionally the

Tuesday after Opex – like in Sept of this year) and then the significant

post opex lows generally occur on the Monday or Tuesday after opex and

occasionally, though not that frequently on the Wednesday after (eg Aug 2010 and May 2011)

Overall,

it feels like the market is positioned for a drop in the Euro and

stocks, so when there is no big news we squeeze higher in both.

I am flat waiting for opex to provide me my next strong market

opportunity.

Wow thanks. So much info here.

What you use for hourly OS and OB?

Hi!

Like you, I am a data / research junkie!

I have experimented with a variety of OS / OB indicators and I have settled on the 14 period MFI and the 9 period RSI – both hourly and I have being using MDY – ie, the midcaps, as they move much more both to the upside and downside. I have been following it for years and have been keeping detailed stats (all kept in a spreadsheet as there are difficult to re-create)

Anyway, I will let you know when I get a signal…..

THANKS!

-D

Thanks, got you.

There are news (in response to “Overall….when there is no big news” )

1. Goldman Sachs with the biggest derivatives exposure: http://www.cross-currents.net/charts.htm

2.This could be the sentence of the year: “in under two weeks, Goldman has taken over both the ECB and Italy”: http://www.zerohedge.com/news/mario-monti-italys-new-prime-minister

Far East Monday morning: S&P future opens up at 1266.80

Cobra, it looks like SPX higher than 1293 is guaranteed based on your MAD chart. It seems like 200MA will get conquered for good pretty soon. Just hard to beileve this given what has transpired – but maybe things are not that bad as the media has been making it out to be.

Now thats a long bar

uempel – just want to let you know in advance that I appreciate your time. Since you seem to have a great grasp for the $bp% and the circle tool I have a question for you. This charts that I attached – to me is turning bearish. Is that how you see it? What happens if it price sells off hard this week and breaks out of the bottom of the circle. How would you view that? When using the circle tool are there bullish and bearish breakouts? If so what determines the difference. Thanks again and appreciate everyone on this site. I have learned so much.

Thanks gator. I like your weekly BPSPX charts – they convey the same message as many other charts, bullish percentages and SPX/NYSE are at resistance and 1275 will be tough to break.

Circles/ellipses work like Andrews Forks, Fib Fans or other tools such as important MAs (Monday I would check Fib MA 191 at 1270.45 which corresponds +/- with MA 200 and daily BB/20/2 which is now at 1290.82) – they show support and resistance. A break can be for real or it can fail and fool us all. To answer your question: the bottom of the circle is support and a break of support is a bearish signal.

Next week: problem for the bears is that some indicators look quite positive short term, e.g. medium term momentum is pulling the market up and short term momentum should turn up Monday/Tuesday. And don’t forget, seasonality is bullish, Wallstreet does not want the markets to tank right now.Why don’t you wait a bit and watch the market behavior these next days/weeks? Suggest you school yourself in patience and wait for more evidence to support your bearish views. It’s midnight and I’m checking the monitor – Far East is all up… Time for bed.

Thank you for being a part of this great community.

Gator, I hope you did not follow my advice and that you went short Monday morning… (I tend to be very/too careful when I see too many conflicting signals, but that’s my personal trading philosphy).

Haha dont worry. I always try to align myself with the weekly and I believe its time for the weekly to roll over. Now I am just waiting for my trigger on the daily chart to hopefully ride the wave. We shall see…. good luck trading and keep up the posting. I love your work & I am a sponge

RUT Time Ratio…

http://astrofibo.blogspot.com/2011/11/rut-time-ratio.html

CADUSD Time Ratio…

http://astrofibo.blogspot.com/2011/11/cadusd-time-ratio_14.html

SP500 Time Ratio…

http://astrofibo.blogspot.com/2011/11/sp500-time-ratio_14.html

thanks for the report