SHORT-TERM: COULD SEE MORE PULLBACKS

Two cents:

- Before the Nov 1st lows being decisively broken, officially trend is still up. I don’t consider today’s tiny little lower low as a valid breakdown, so bears, no champagne just yet.

- Chances are today’s low is not the low, so basically, I believe the Nov 1st lows will be broken eventually.

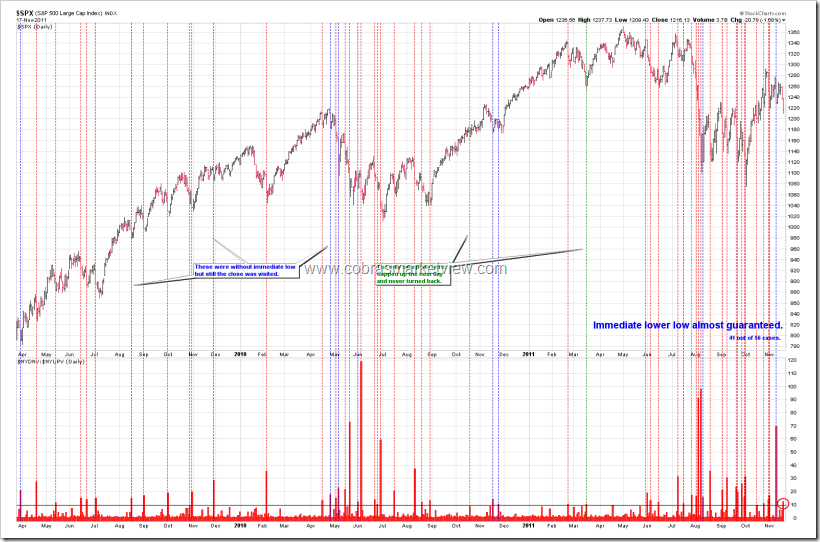

The chart below explained why the Nov 1st lows must be decisively broken before an official intermediate-term downtrend is possible (pay attention to this “possible”).

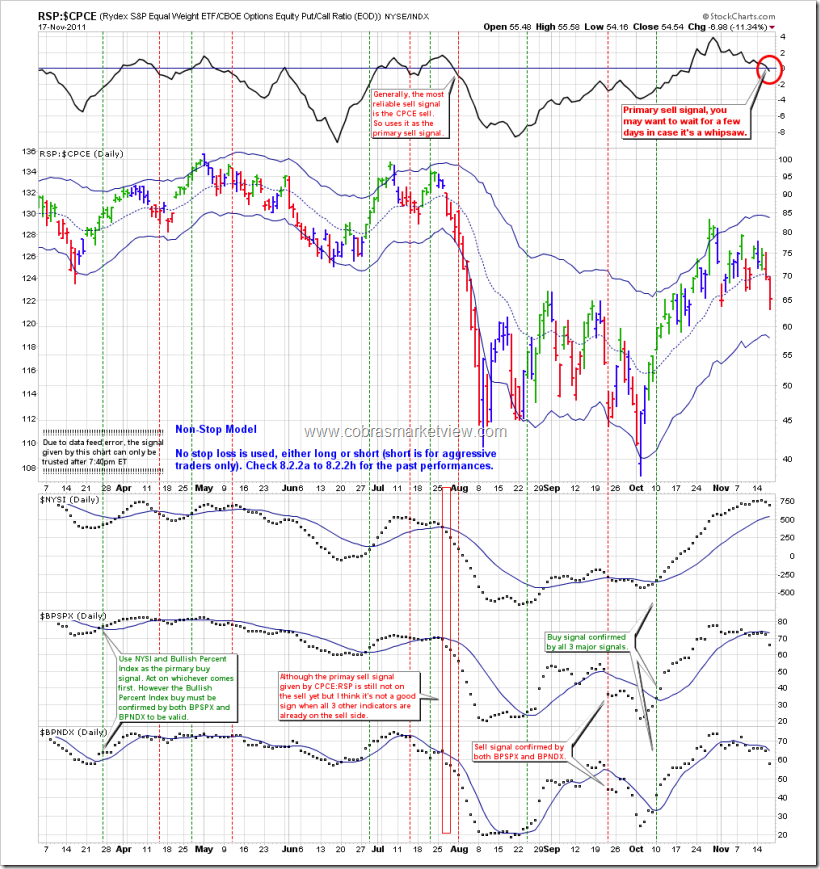

- Besides to meet all the conditions required by the 1-2-3 Trend Change, $120 must be taken too, otherwise it still could be an ABC wave down or Bull Flag on daily chart.

- If indeed the Nov 1st lows broken, then we’d have a Double Top with text book target around $115 and 73% chances to meet such a target. I think the target might have some credit because the Symmetrical Triangle text book target shown on SPX daily chart below points to 1160ish, which is close enough to $115.

Now let’s talk about why I think the low wasn’t in yet.

- Today is a Major Distribution Day, implying a strong down momentum, so 73% chances we’d see a lower low tomorrow.

- Non-Stop model issued a sell signal today. Click on Non-Stop, you’d see the back test shows that there’re only 2 out of 27 (7.4%) chances that today’s low was the low. While there’re 73% chances, SPX would drop at least 10 more calendar days before a bottom could possibly be in. Those who follow the Non-Stop model, may need close long and take short tomorrow. You can always choose to wait for a few more days to avoid whipsaws though.

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY, WILL NEED REASSESS SPX 1,000 DOWNSIDE TARGET

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details. I’m not sure about this call anymore, will need more evidences to reassess.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: COULD SEE MORE PULLBACKS

两点说明:

- 在11月1号的lows decisively broken之前,officially trend is still up。我不认为今天刺破那一点点算是跌破了,所以现在还不是熊熊开香槟的时候。

- 应该还没有跌完,所以基本上我认为应该会跌破11月1号的lows。

下面的图解释了为什么说11月1号的lows要decisively broken,才可能算(注意这个“可能”)officially downtrend。

- 基本上,除了要符合1-2-3 Trend Change以外,最好要跌破$120,否则还是能解释成,ABC wave down or Bull Flag on daily chart。

- 跌破11月1号的lows,就可能是个Double Top,target $115左右,有73%的机会到达这一目标。我认为这一个目标还是有一定的可信度的,因为再下面的SPX daily图上的Symmetrical Triangle text book target是1160左右,两者比较接近。

下面谈谈为什么我认为还没有跌完。

- 今天是Major Distribution Day,表示下跌的动能很大,所以73%的机会,明天会有lower low。

- Non-Stop model出卖信号了。点击Non-Stop,可以看到,我有验证,只有2 out of 27 (7.4%)的机会,今天的low是the low,而有73%的机会,大盘至少还会跌10个calendar days左右才到底。跟Non-Stop的同学,明天应该close long并且反手short,当然,你总可以多等几天,以防是whipsaw。

INTERMEDIATE-TERM: WE COULD SEE MULTIPLE WEEKS RALLY, WILL NEED REASSESS SPX 1,000 DOWNSIDE TARGET

For why we could see multiple weeks rally, please see 10/14 Market Outlook for details.

For why SPX downside target at 1,000, please see 08/19 Market Outlook and 09/30 Market Outlook for details. I’m not sure about this call anymore, will need more evidences to reassess.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

cobra thanks for the report. Can you give your thoughts on the possible QQQ scenario. ?thanks

could be roof formation breakdown.

thanks cobra/ 1

Cobra: great report, however, for tomorrow dont you expect to close in green?

yes, gap up then green could be because VIX dropped a lot before the close. That got me really worried for bears. 🙂

thx,ding

Bout time I contributed something. Here’s a picture of today’s EOD SPY spike that correlated with DOW up 50 pts right at close. Thanks CBOE. One very humbling request. From deep mountain backwoods dial-up and working on satellite something for next week, could someone, please, during tomorrow’s intraday put up an intraday $gold and/or $silver with some Sto, Rsi, 5DMA, whatever indicators? And BIG thank you to Cobra and ALL contributors.

thank you. where is the donation box for your server? It is not fair if you need to pay for it.

Thanks Cobra, here’s a char that shows a bit if hope for the bulls, nasdaq rydex looks a bit oversold, not to say it can’t stay oversold…

The “Tiger formation” posted by uempel in Trading Signals reminded me of the “Dragon” pattern that someone brought to my attention on the NDX back in the early part of 2009.

http://www.trading-naked.com/images/DragonPattern/JerryWar.gif

http://www.trading-naked.com/JerrysDragonPattern.htm

SPX daily may find the short term support at a convergence of MA50 and Fib38.2 (1,205.60-1,209.60). Considering this is a combination support plus 2 big red days in a row which make the SPX hourly very oversold and therefore may due for a rebound day.

Pay our attention to a fact that from Oct 27 (the interim top day and the beginning day of a down channel limited by pink lines) all the rebounds from the lower end or from the middle line of the channel enjoyed 2 days alive.