SHORT-TERM: NOT SO BRIGHT

The bottom line, the selling wasn’t over yet, although I’m not sure if the current rebound was over or not.

- You bet I’d say the down momentum was way too strong, so rarely the very first rebound could be successful, because you Earth people always like to try twice and only failed both time, would then try the opposite direction, so chances are there’s at least one more try to test the 11/25 lows before a solid bottom is possible.

- You bet I’d say, the rebound so far looks like a Bear Flag, therefore eventually would continue on the downside.

To understand the above 2 arguments, you need some experiences. Simply because it’s Cobra said and occasionally this guy could be right and the fact you’re visiting this guy’s territory, so you dare not speak against it publicly, but you still murmur, come on, give me a break, it’s empiricism! Well, let’s look at something more “visual”, see chart below:

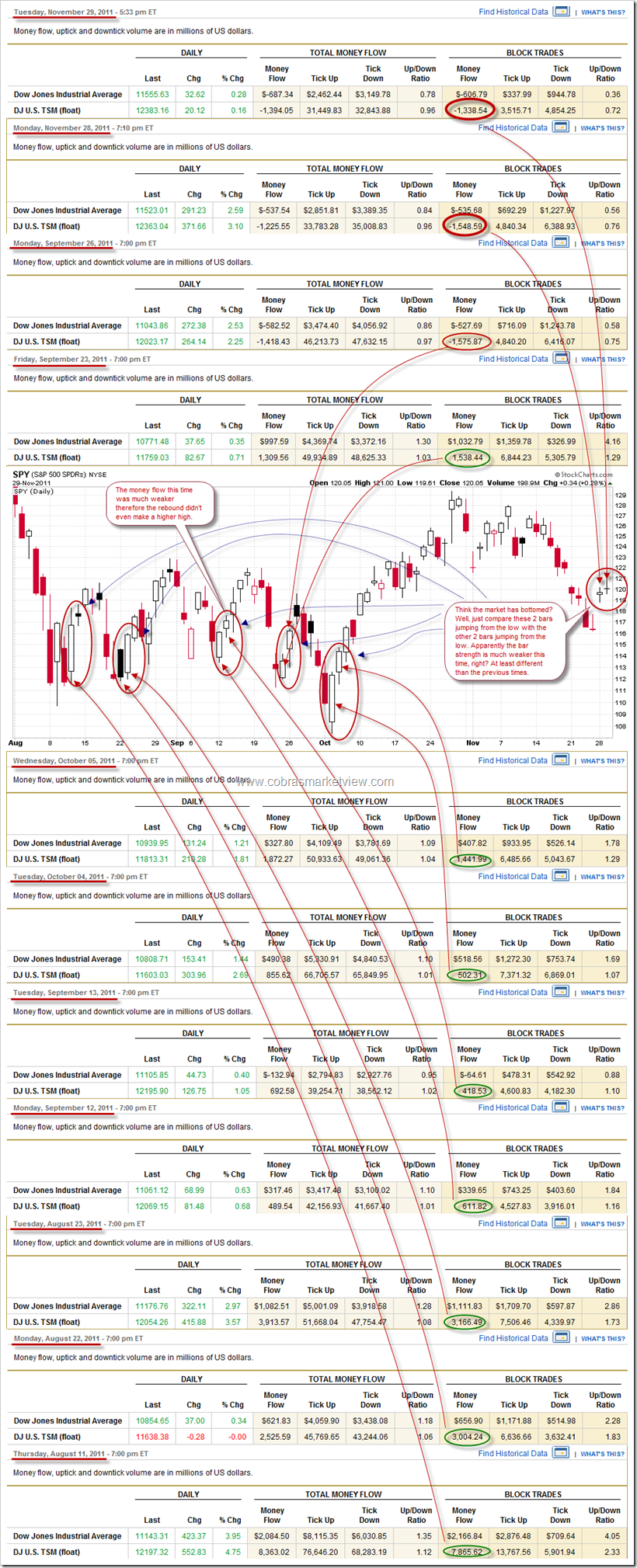

- SO FAR the bars on this round of rebound are different than the previous several times when SPY rebounded from its low where most bars were “rise from open to close” kind of bull bars. Doji is not something can be called a strong bull bar, agree? Utilizing the overnight very thin trading volume, via highly leveraged futures to lift the market skyrocket high then simply goes nowhere in the daylight, well, just tell me, what this kind of behaviors mean?

- And there’re more, take a look at the money flow, how positive they were when the previous several times SPY rebounded from its lows. Then take a look at the very negative money flow now. Huge differences, aren’t it? And this should enough explained why the market gapped up high then spent the day going nowhere.

At least you have to admit, that SO FAR this rebound is a little different, don’t you? So if I say (forget I’m a Cobra that I can bite people) let’s take a little caution here, isn’t too much to ask, is it?

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

See 11/18 Market Outlook for more details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

Chinese Transcript

SHORT-TERM: NOT SO BRIGHT

The bottom line,还没有跌完,但我不确定反弹是否结束了。

- 我说这么大的下跌动能,不可能第一次反弹就成功,因为你们地球人什么事情总是喜欢试两次,两次失败后才可能试相反的方向,所以至少还有一次探底的动作,失败后才可能到底。

- 我说这两天的反弹看起来像是Bear Flag,因此最终还会continue down。

以上两个理由,需要点经验,是Cobra说的,尽管Cobra偶然才能蒙对一次,但是估计大部份人不敢说不信,心里可能嘀咕,又忽悠咱是吧?那好吧,我们今天搞点直观的。

- 下面的图,这次反弹形成的两根棒棒,是不是跟前几次刚从底部弹起的光头光脚的大棒棒不同啊?Doji不是个什么strong bull bar,这你同意吧?晚上趁人少没啥阻力的时候用Futures把大盘抬上来,白天就横在那里,你说是在干啥?

- 那,还有,再看看以前几次从底部的反弹,money flow是啥样子的,我们这次呢?负的很厉害,更前几次没法比,是吧?这就解释了为啥子高开后,就横在那里了。

至少你不得不承认,这次的反弹和前几次有点点不一样,是吧?所以我说提高警惕,防止阶级敌人复辟,多少有点道理,对吧?

INTERMEDIATE-TERM: EXPECT MULTIPLE WEEKS SELLING AHEAD, TARGETING JUNE 2010 LOWS AROUND SPX 1010ISH

See 11/18 Market Outlook for more details.

| SUMMARY OF SIGNALS: | ||||||||||||||||

|

||||||||||||||||

| * = New update. |

I was also shocked to see that the outflow was again this big after the market close. It wasn’t that bad right before 4pm …

Sometimes outflow doesn’t mean anything, so more solid evidences needed to call top.

Thanks Cobra! Great report as always.

thx,ding

I paid today, and cannot register, what shall I do?

Forward your paypal confirmation email to cobra@cobrasmarketview.com, I’ll check for you, thanks.

Hi Cobra. I signed up for the monthly plan a few days ago. I’m very much a lurker, but I wanted to let you know I definitely appreciate you market insight (especially the daily market discussion on the forum). While I probably won’t be posting much if at all, I wanted to show my support by signing up for the monthly plan. Just wanted to let you know that some of us lurkers appreciate what you do as well.

Thank you so much!

Just for fun I checked the history of the DMA 377: never before has it emitted a misleading signal for 4 weeks (mid-November to mid-October). Was this a huge bull trap, or is 377 misleading and useless at the moment?

As to my personal opinion, which ain’t worth nothing: I’m waiting for a further bullish attempt to break to the upside, I don’t expect that bulls capitulate just yet. I’m closely monitoring DMA 55, now at 1204.84. If this level is not broken in the next few sessions I’ll be playing along with the bears.

Very interesting report, but, then again, I’ve come to expect those. But, something does confuse me. Here in Texas we have lots of snakes, but I can’t recall running into one that had a well-developed sense of humor, especially a self-deprecating one. Are Cobras different?

Ha, thanks. I was really happy with myself about this innovative report, but sadly, it’s wrong. 🙂

Maybe it’s better to be innovative than right. What I mean by that is that today’s market may be an outlier, but your insights may have lasting value.

Thanks. I wish all my readers are as supportive as you. 🙂

http://img14.imageshack.us/img14/5758/spxextremestudypub.jpg

very nice chart HighRev, thanks very much for that effort

I’ve pitched my old wave count for now fwiw as the rebound in October was expected but stronger than I expected, mostly long, no leverage, small hedges

good luck to you

Ha, ha, ha. I’m not long, but did you guys see the futures…

yep……lol

The chart:

I was short… very short… almost deadly short…

snif…!

NOT NOT SO BRIGHT

Michael G: I didn’t want to be pretentious. Market movements can be soooo ludicrous that labor and effort of the undersize speculator is doomed… Problem is that speculation with a small amount of money is not lucrative, and increasing the amount can wipe us out. Conundrum of the little guy.

I know Uempel. Don’t worry. And you are right playing this with little money is not going to make you rich. Mainly cause you use big leverage so when things go wrong they are really wrong. Well, Let’s see what happens next. Are we going to try an even higher price, or a correction is needed (well “needed” is not the word)

Cobra, these kind of incidents are unreal: you work day and night to analyze the data and to help us predict the next ups and downs of the market, and then some outside action unravels everything and your efforts are doomed…

is that really fair to whats happened here, are you stating that at 1158 you couldn’t find any evidence of a potential bounce, perhaps a good idea to cover shorts and take profits until the next direction was revealed?

triangle target?

the 61.8?

an oversold RSI?

and a host of other factors…..

granted, yesterdays candle wasn’t exactly confidence inspiring, but it was one puzzle piece……

Of course you’re right. Expected neither an upwards nor a downwards crash, saw more nibbling at 1200/1210 resistances, didn’t see any urgency to open a position…

well, it’s never easy, of course….

here’s what Im watching now, just basics

extending the lines of the triangle break we’ll note that the price action is coming up to the apex of that triangle now on $spx, this is quite common for triangles, the question is what happens there, I will take some profits off longs today accordingly and/or readjust stop levels.

good luck unempel, still checking your charts, wish I had some more time to comment on here

Hey, it’s a reality, we have to live with that. The lesson I learnt today is: If I think the report I just posted was excellent or innovative, well, it’s time to go wrong. 🙂